Our commitment to responsible practices touches many aspects of our business, enabling the Bank to drive positive impacts through our products and services. Our approach infuses trust into our brand and industry, promotes sustainable growth, and positively influences the communities we serve. We are dedicated to achieving a higher standard of sustainable business through a series of initiatives, including the development of Green and Sustainable Finance (GSF) business across the Group and strengthened risk management processes.

Supporting the Transition to a Low-carbon Economy

Answering the call on financed emissions

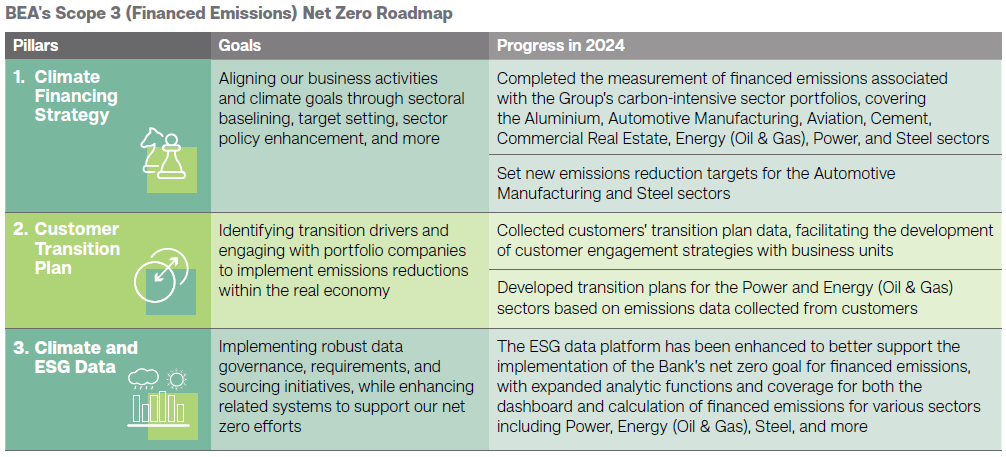

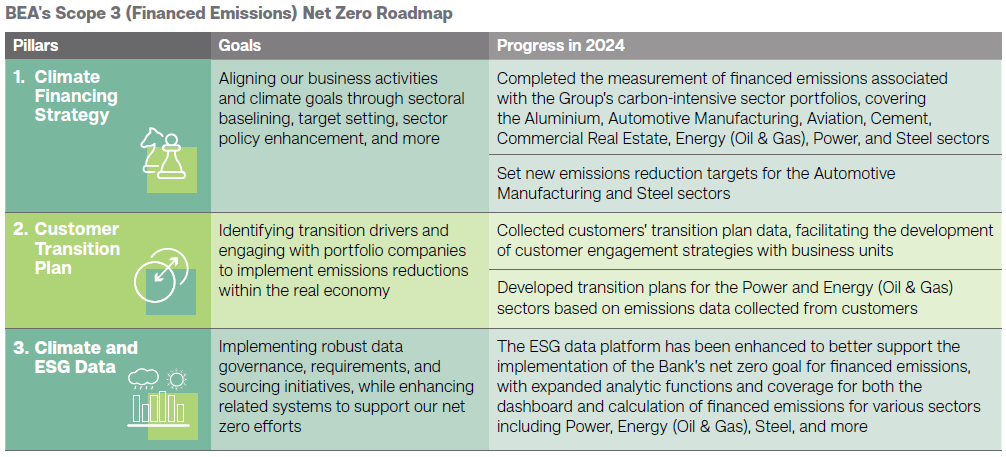

Financed emissions comprise more than 99% of the Group’s total emissions, with more than 90% originating from the Group’s corporate lending and bond investment portfolios. Recognising the important role BEA plays as a provider of capital in the fight against climate change to fulfil the aims of the Paris Agreement, we are advancing the goal of achieving net zero financed emissions by 2050 guided by the three pillars of our Scope 3 Net Zero Roadmap, and made significant progress in 2024.

As a signatory to the Partnership for Carbon Accounting Financials (PCAF) andNet-Zero Banking Alliance (NZBA), we have measured financed emissions in prioritised carbon-intensive sectors, set carbon reduction targets, and report our annual progress against these sectoral targets. For details on our advancements toward these sectoral targets, please refer to the Climate-related Risk and Resilience section – Metrics and Targets of our latest Environmental, Social, and Governance (ESG) Report.

Growing our green and sustainable finance business

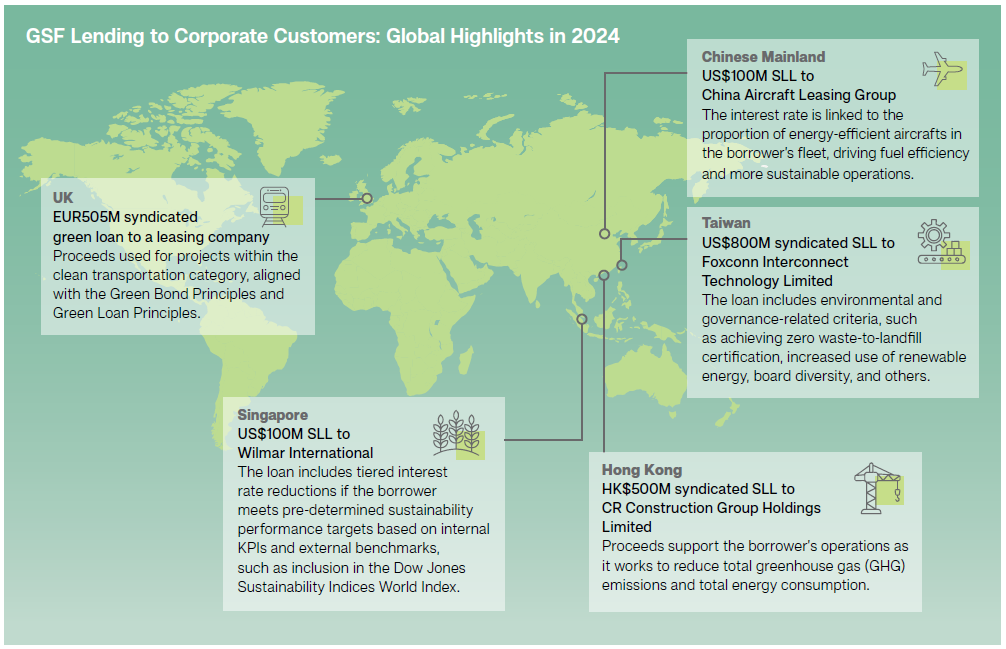

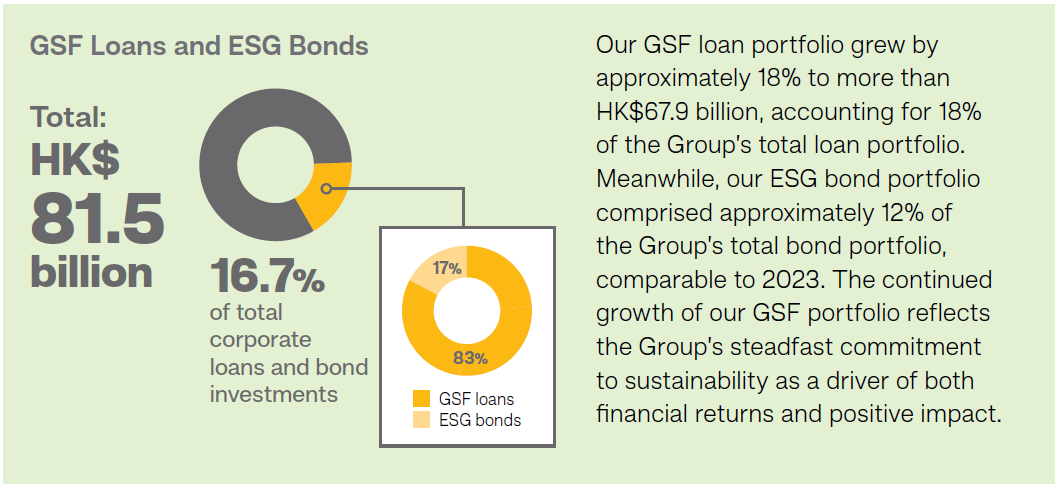

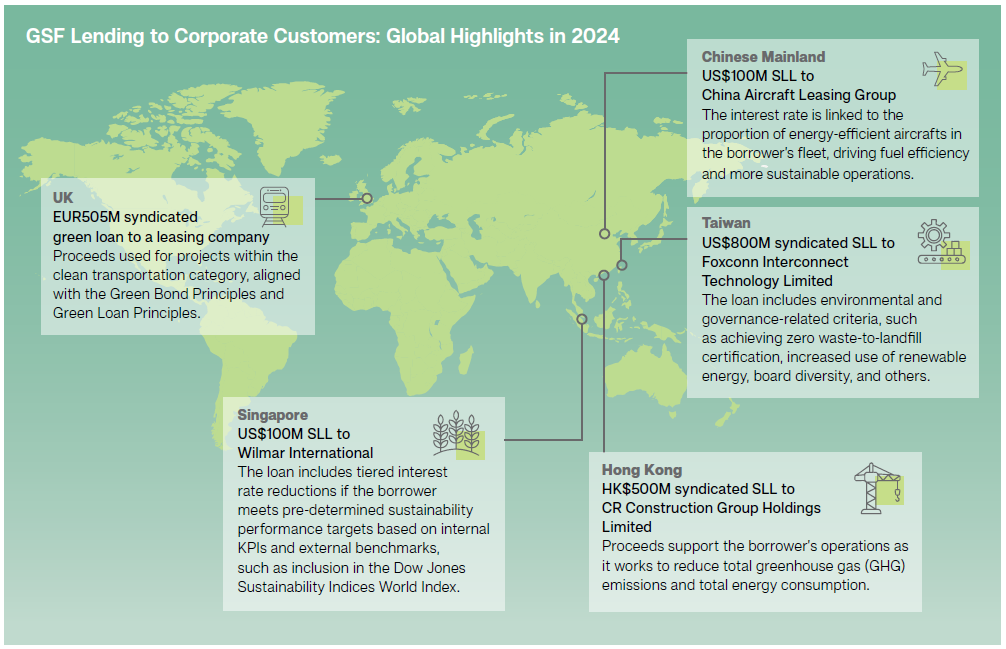

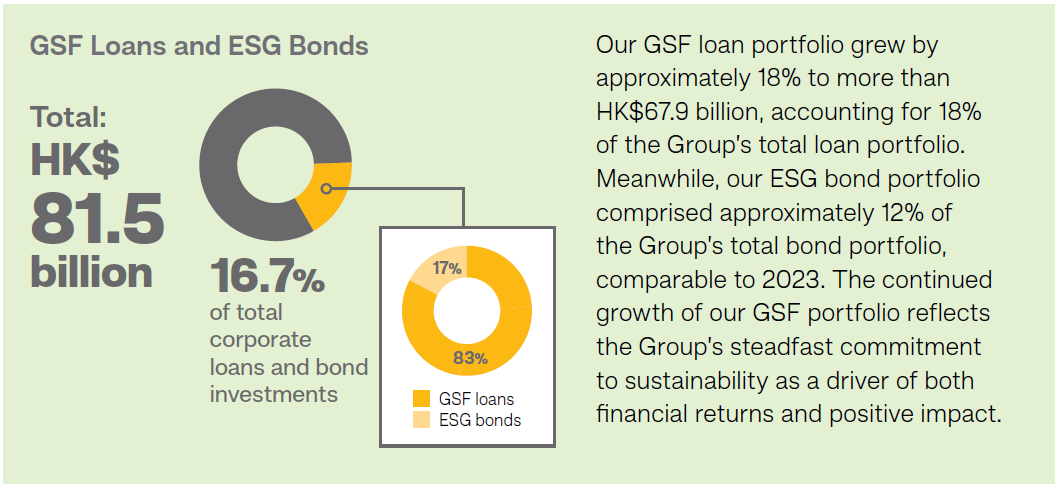

We have developed and rolled out sustainability-focused products and services across the Group to support our customers on their own sustainability journey. For instance, we offer GSF lending solutions for corporate customers and participate in global sustainability-linked loans and syndicated transactions.

Sustainability is also embedded in our debt investment strategy through ESG bond investments. We are directing more and more capital towards projects and businesses of investee companies that have climate ambitions and visions aligned with ours.

In 2024, we formulated a strategic plan emphasising active portfolio management for the Power and Energy (Oil & Gas) sectors, with action plans based on actual emissions data and portfolio maturity profiles, considering the transition plans of investee companies.

Managing our ESG and climate-related risk proactively

Our robust Enterprise Risk Management (ERM) framework effectively identifies and manages potential risks, including ESG and climate-related risks, in alignment with the requirements established by the Hong Kong Monetary Authority (HKMA).

In early 2024, the Bank integrated a new cloud governance and risk management framework into its ERM framework and created a Cloud Risk Monitoring Team to oversee cloud computing-related risks, with a strong focus on cybersecurity controls and data protection measures. This new framework also guides the Bank’s use of AI technologies to ensure robust cybersecurity measures and safeguard data and systems.

As BEA continues to invest in GSF opportunities, we remain mindful of the significant risks posed by greenwashing. To this end, since 2022, BEA has implemented a GSF framework with consistent, technically sound definitions and methodologies as well as tools to identify and assess the environmental and social impacts of the projects we finance to mitigate greenwashing risk in our GSF portfolio. It has been designed to cover a range of financial solutions provided by the Bank, including loans, bonds, working capital finance, trade finance, and bank guarantees.

On the critical issue of climate change, our GSF framework adopts the IMPACT+ Principles for Climate-Aligned Finance, a recognised approach to achieving real economy decarbonisation towards a 1.5°C future.

As part of our GSF framework, a List of Prohibited Lending specifies transactions or activities that BEA will not knowingly extend financing to. These transactions and activities are:

- Development, manufacturing and trading of firearms

- Production or trading of wildlife products in violation of the Convention on International Trade in Endangered Species of Wild Fauna and Flora

- Activities that would adversely impact areas that have been designated as UNESCO World Heritage Sites

- Activities involving exploitation of children and human trafficking

- Activities resulting in degradation and/or destruction of:

- any biodiversity value areas; or High Conservation Value, High Carbon Stock forests or peatlands, wetlands designated under the Ramsar Convention on Wetlands of International Importance, or

- the natural sites designated by UNESCO as the World Heritage Site

- Unauthorised logging or deforestation

- Plantation operations that use fire to clear the land in preparation for planting

- Activities that are directly related to the exploitation, development, or production of oil and gas within the Arctic Circle

- Mountaintop-removal coal mining

- Operations which practice shark finning or trade in shark fin products

- Illegal Unreported and Unregulated fishing; this also includes operations which practice drift net fishing, deep sea bottom trawling or fishing with the use of explosives or cyanide.

Additionally, our new product approval procedure requires business units to consult the Sustainability Department and ESG Risk & Oversight Department on ESG-themed products and services. This helps ensure products and services support proper ESG causes and subject matter expertise is applied to identify and address potential greenwashing risks before they materialise.

For details on how BEA manages climate-related risks, please refer to the Climate-related Risk and Resilience section of our latest ESG Report.

Promoting Responsible Products and Services

Our commitment to delivering responsible products and services is built on two core principles: addressing evolving customer needs and ensuring strict compliance with local regulations. BEA is also a signatory to the HKMA’s Treat Customers Fairly (TCF) Charter.

Developing cutting-edge, inclusive products and services

Our banking solutions are designed to meet the diverse needs of different customer segments, from providing financing for local businesses and small and medium enterprises (SMEs) to offering cutting-edge platforms for digitally savvy customers and donation collection services for non-governmental organisations (NGOs).

As we continue to position ourselves for success in an increasingly digitalised world, we have enhanced our services through online channels. A major milestone was achieved in February 2024 with the introduction of our revamped BEA Mobile banking app. This redesigned mobile banking app features a suite of wealth management services with up to 14 investment functions covering stock trading, unit trusts, linked deposits, and foreign currencies.

In March 2024, we took another significant step forward by partnering with PingAn OneConnect Credit Reference Services Agency (HK) Limited to streamline the credit evaluation process for SMEs in the trade sector by leveraging the HKMA’s Commercial Data Interchange. We simultaneously launched Trader Loan, a new loan product under the BEA Enterprise Easy Fund Series, and cut the approval process to three days, giving SMEs access to financing support more swiftly.

In addition, our comprehensive digital banking platform, BEA Corporate Online, simplifies daily financial tasks and supports functions like real-time transaction monitoring and payroll processing, so that corporate customers can efficiently manage their banking needs.

Providing service excellence

Our quest to ensure a positive customer experience is guided by ISO 10002:2018 Quality Management: Customer Satisfaction Standard. Applying this standard helps us monitor trends, identify external and internal issues, and eliminate causes of complaints leading to continual improvement in our operations, products, and services.

To measure satisfaction, we collect feedback through a quarterly Net Promoter Score (NPS) and Transactional Surveys, alongside an annual Mystery Shopper Study that evaluates service quality across various touchpoints, including in-branch, with relationship managers, and through digital channels. These insights inform cross-departmental improvement plans to uphold service excellence.

In 2024, we introduced a new OneBank CRM (Customer Relationship Management) platform to equip our sales and relationship managers with deeper insights into customer needs and preferences. The platform integrates backend systems to provide a complete view of customer profiles and includes tools for evaluating customer risk profiles and tailoring product offerings. The first phase of our One-Stop Know Your Customer (KYC) platform has also been rolled out, providing a unified customer view for risk assessment and compliance. Together, these initiatives enable us to better understand customer financial capabilities and deliver customised products more effectively.

Promoting financial literacy and inclusion

To foster financial inclusion and education while serving our customers, we continuously explore ways to connect with different demographics and markets we serve. By tailoring our strategies, we aim to ensure our services not only meet the needs of all customers but also empower them with the knowledge and tools to thrive in today's digital banking world.

Building on this commitment, one of our primary goals is to make our banking services easily accessible to everyone. Across our branch network, we have taken tangible steps, such as installing specially designed teller counters and ATMs to assist customers with wheelchair needs, visual or auditory impairments, and other challenges. Additionally, recognising the unique needs of individuals with hearing impairments, we have introduced a conversational live chat service on the BEA website and BEA Mobile, offering an inclusive and seamless customer experience.

As part of our inclusivity efforts, we strive to bridge the digital divide by helping customers aged 60 and above in their adoption of digital banking services. Following the launch of the revamped BEA Mobile app, we intensified promotional efforts among this group, with results exceeding expectations—increasing the digital active ratio to 25.5% by the end of 2024.

Through direct engagement with elderly customers, we also promote financial literacy. For instance, in the UK, we hosted a Fraud Prevention Education Seminar in November 2024 for elderly members of the local Chinese community. This seminar addressed real-life cases of six common scams, equipping attendees with practical fraud prevention tips presented in a handy pamphlet to share with others.

For more information on other financial literacy initiatives and community programmes, please refer to Responsible Citizen.

Safeguarding Cybersecurity and Data Privacy

The foundation of cybersecurity and data privacy governance at BEA rests on the "Three Lines of Defence" risk management model. This model helps the Bank capture and monitor cybersecurity and data risks, while clarifying the roles and responsibilities of committees involved. The effectiveness of the cybersecurity and data protection governance framework and control processes is independently and regularly assessed by the Internal Audit Division following a risk-based approach or by a qualified external assessor.

On the data privacy front, BEA fully complies with personal data privacy laws in all jurisdictions where it operates, including the Hong Kong Personal Data (Privacy) Ordinance, the UK General Data Protection Regulation, and the Chinese Mainland Personal Information Protection Law. Comprehensive policies and guidelines have been established to help safeguard our customers’ data and personal information privacy.

Our Group Privacy Policy sets out general personal data protection principles that apply across BEA Group members, helping to ensure that personal data is handled with care and confidentiality, and with respect for individual rights. Meanwhile, our Privacy Policy Statement outlines our approach to data collection and retention, in line with regulatory requirements.

While the rapid pace of digitalisation presents unparalleled opportunities for growth, it also necessitates robust cybersecurity measures to safeguard systems and data within an evolving threat landscape. Our Information Security Policy provides a comprehensive framework detailing the infrastructure, organisational structure, and our employees' responsibilities essential to managing information security. In addition, the Policy clearly sets out the information security requirements for third parties. It highlights the Bank’s commitment to continuously improving its information security systems, ensuring integrity and protection of data, and vigilance and responsiveness to related threats.

In the Chinese Mainland, BEA China has put in place Implementation Guidelines for Cross-Border Data Security Assessment, and in 2024, applied for a security assessment project for the export of personal data, which was approved by the Cyberspace Administration of China. Moving forward, BEA China and BEA will work together to meet the compliance requirements.

Upholding Business Ethics and Integrity

Upholding high ethical standards is essential for the long-term success and sustainability of our business. The Group Policy on Anti-bribery and Corruption, which is reviewed and approved by the Board of Directors on annual basis, is communicated to all employees.

Additionally, the Bank’s Code of Conduct addresses a wide range of topics, including corruption and bribery, discrimination, sexual harassment, use/confidentiality of information, conflicts of interest, money laundering, insider trading/dealing, and more. Each year, all staff members are required to read the latest version of the Code, declaring their understanding and confirming compliance with it and the policies embedded therein.

The Bank also conducts mandatory training on the Code of Conduct to all employees, including part-time and contract staff. This training covers the Whistleblowing Policy and Procedure, which outlines available reporting channels for addressing unethical business practices.

BEA is also a signatory of the Banking Industry Integrity Charter (Integrity Charter) introduced by the Independent Commission Against Corruption (ICAC). The Integrity Charter aims to combat and prevent corruption through public-private partnership, assisting banks to enhance integrity management systems while strengthening corruption prevention awareness and related capabilities.

By signing the Integrity Charter, BEA is strengthening its sound bank culture and reiterating its commitment to the Bank's Code of Conduct. We have appointed an integrity officer to assist the Bank in the oversight and implementation of good governance. We also provide integrity training to staff and promptly report suspected corruption, fraud and other illicit activities to the ICAC or other law enforcement agencies promptly.

For more details about the Integrity Charter, please visit ICAC’s website.

To learn more about our ESG initiatives and recent updates, please refer to Responsible Business section of our latest ESG Report.