Important Note:

1. BEA Wise All Weather Fund (the “Fund”) is subject to general investment risk, asset allocation risk and currency risk.

2. The Fund is subject to risk of termination of the investment advisory agreement (the “IAA”) with BEA. The Fund may either have to undergo material changes in investment objective and policy or be terminated if the IAA is terminated.

3. The Fund may invest in Exchanged Traded Funds (“ETFs”), which may not be actively managed and is subject to risks relating to investment in ETFs generally. Falls in the related tracking index are expected to result in a corresponding fall in the value of the relevant ETF. An ETF’s returns may deviate from that of its tracking index.

4. The Fund may invest in other funds and will be subject to the risks associated with the underlying funds. The underlying funds in which the Fund may invest may not be regulated by the SFC. There may be additional costs involved when investing into these underlying funds.

5. The Fund is subject to equity markets risk such as changes in investment sentiment, political, economic conditions and issuer-specific factors which may adversely affect the fund value.

6. The Fund invests in debts securities and are subject to risks in interest rates, credit/ counterparty, downgrading, below investment grade or non-rated securities, volatility and liquidity, valuation and sovereign debt, credit rating risks which may adversely affect the price of the debt securities.

7. The Fund invests in emerging markets and may be subject to increased liquidity risk, currency risk/control, political and economic uncertainties, legal and taxation risks, settlement risks, custody risk and the likelihood of a high degree of volatility.

8. The Fund may use financial derivative instruments for hedging and investment purposes which may not achieve the intended purpose and may result in significant losses. Risks associated with derivative instruments include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk.

9. The manager may at its discretion make distributions from income and/or capital in respect of the distributing classes of the Fund. Distributions paid out of capital amount to a return or withdrawal of part of the unitholders original investment or from any capital gains attributable to that original investment. Such distribution may result in an immediate reduction of the net asset value per unit. A positive distribution yield does not imply a positive return.

10. In terms of currency hedged class units, adverse exchange rate fluctuations between the base currency of the Fund and the class currency of the currency hedged class units may result in a decrease in return and/or loss of capital for unitholders. Over-hedged or under-hedged positions may arise and there can be no assurance that the currency hedged class units will be hedged at all times or that the manager will be successful in employing the hedge.

11. RMB is currently not a freely convertible currency as it is subject to exchange controls and restrictions. Non-RMB based (e.g. Hong Kong) investors are exposed to foreign exchange risk and there is no guarantee that the value of RMB against the investors base currencies (for example HKD) will not depreciate. Any depreciation of the RMB could adversely affect the value of investors’ investments.

12. Investors should not make an investment decision based solely on this material.

BEA Wise All Weather Fund

Navigating Through Market Changes, Rain or Shine

What is the BEA Wise All Weather Fund?

BEA Wise All Weather Fund is the first fund jointly constructed by Bank of East Asia and BEA Union Investment. Through the collaboration between both parties, this fund has established a globally diversified portfolio that encompasses global equities, bonds, commodities, alternative investments, and cash. This robust investment framework enables investors to navigate various market environments effectively.

Why BEA Wise All Weather Fund?

Combining BEA's^ vision and BEA Union^^ Investment's expertise

- The Bank of East Asia's investment strategy team BEA Wise provides strategic macro advice as an investment advisor and makes suggestions based on macroeconomic conditions and forward-looking market trends.

- The two teams hold regular investment meetings, making timely adjustments based on the latest market insights to manage fluctuations and achieve long-term results.#

A Diversified Portfolio

A diversified portfolio to seek medium to long-term capital growth and income

- Explore markets across the globe, including the United States, Europe, and the Asia-Pacific region, while diversifying across asset classes such as stocks, bonds, commodities, real estate trust funds, and cash. Aim for stable returns and growth potential.

- Utilize a professional asset allocation framework to determine the proportions of various indexes and asset classes to avoid over-concentration and control volatility, helping you better manage your investment journey.

Opportunities across four key asset classes

Broadly participate in diverse markets and asset classes through investing in mutual funds and ETFs across different regions and themes*

^BEA serves as the Investment Adviser of the Fund, advising on the Strategic Asset Allocation (as defined in the Product Key Facts Statement under ‘Objectives and Investment Policies’) . The discretionary investment management function of the fund is solely vested in BEA Union Investment

^^BEA Union Investment Management Limited, a non-wholly-owned subsidiary of The Bank of East Asia, Limited (“BEA”), is a joint venture between BEA and Union Asset Management Holding AG of Germany

*The above investment range is for reference only and may differ from the actual investment range

#The Investment Adviser does not have full investment management authority over the Constituent Funds and its recommendations are not binding on the Constituent Funds.

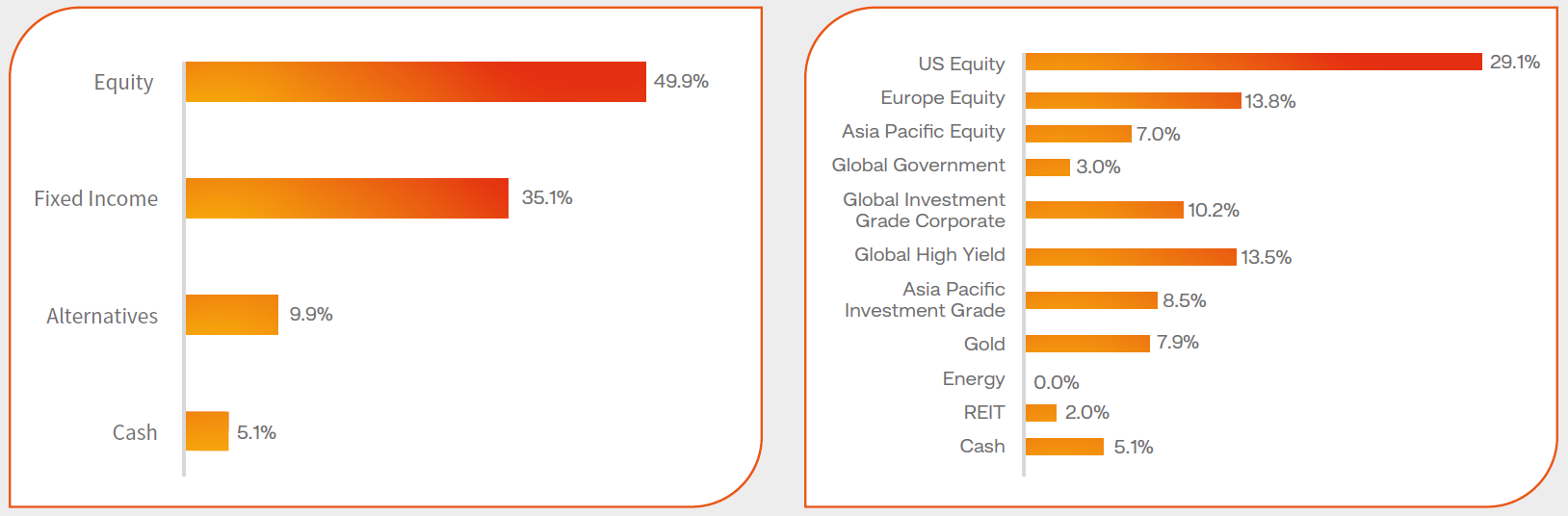

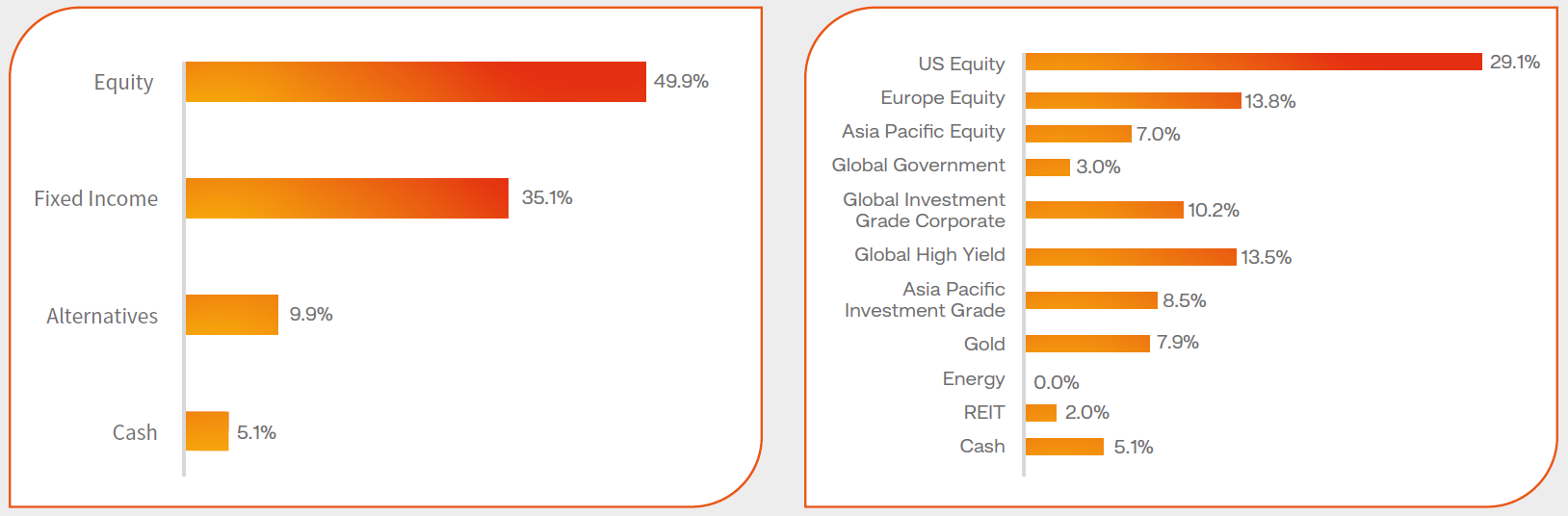

Simulated Portfolio Asset Allocation

Model Portfolio Asset Allocation^ Model Portfolio Allocation in Details^

^Sources of model portfolio: Bank of East Asia and BEA Union Investment, as of February 5, 2025; the model portfolio is for illustrative purposes only and do not represent the actual returns that will be achieved. References to specific securities in this article are for illustrative purposes only and should not be construed as a recommendation to buy or sell the relevant securities. Actual asset allocation may differ. The asset mixes of the model portfolio may be greater/less than 100% due to rounding. As such the values of the geographical and sector allocation displayed may not total 100%. The above asset allocation is for reference only and BEA Union Investment may make changes at any time at its discretion. The fund may change its investment portfolio at any time without prior notice.

Our Partnership

Bank of East Asia - Investment Strategy Team

- Since 2021, BEA has published the "BEA Wise" comprehensive investment report, providing forward-looking market insights and serving as a key reference for the bank’s internal units

- "BEA Wise" covers: Macro investment strategies; macroeconomic analysis; equity market insights, including index and sectoral

analysis across developed markets, Asia, Hong Kong, and China; FX trends; and comprehensive fixed income market analysis for developed and Asian markets

BEA Union - Investment Team

- Established in 2007, BEA Union Investment combines BEA’s local expertise with the global vision of Union Investment, Germany’s second-largest asset manager, with €504.7 billion in assets under management (AUM)^^.

- A team of investment professionals, each averaging over 14 years of experience, specializing in multi-asset investments across global markets, including equities, bonds, alternative assets, and money markets.

- Managing around $7.6 billion in assets# and recognized with over 210 industry awards+, including:

- Asian Asset Management Magazine – Best of the Best Hong Kong CEO & Asian Bond Performance Award (3-Year) 2025

- Fund Selector Asia – Fixed Income House of the Year (Hong Kong) 2025

- Insights & Mandate Awards – Global Equity Performance Award (3-Year & 5-Year) 2024

- Benchmark Magazine – Fund of the Year Awards 2023 (Hong Kong) – House Awards – Asia Fixed Income - Best-in-Class

Note: BEA Union Investment Management Limited is a non-wholly owned subsidiary of The Bank of East Asia

^^ Source: Union Investment, data as of September 30, 2024. Source: BEA Union Investment, data as of December 31, 2024. BEA Union Investment is an independently operated investment management company established as a joint venture between The Bank of East Asia and Germany's Union Investment. The company adheres to relevant regulatory requirements to implement business separation between the company and its shareholders.

#Source: BEA Union Investment, data as of December 31, 2024.

+ Source: BEA Union Investment, data as of December 31, 2024, awards were presented to the company by organizations including Asian Asset Management, AsianInvestor, Benchmark, Insights & Mandates, Fund Selector Asia, Fundsupermart.com, and Lipper etc.

How to search BEA Wise All Weather Fund in BEA Online?

1. Go to our fund search page (click here)

2. Select "BEA Wise All Weather Fund" in "Fund Name"

Please click Demo for further details.

Promotional Offers

| Eligible Customers |

Promotion |

|

New SupremeGold Private / SupremeGold Customers

|

During the promotion period, eligible customers who subscribe for Unit Trusts through branches can enjoy the first-time fund subscription fee as low as 0.88%.

Learn more about the offers, please visit the websites below:

- New SupremeGold Private Customers (Click here for promotion details)

- New SupremeGold Customers (Click here for promotion details)

|

| New / Selected SupremeGold Customers |

|

| New / Selected Supreme / BEA GOAL Customers |

|

Remark:

Investment involves risks and the above products, services and offers are subject to the relevant terms and conditions. For details of the terms and conditions of the offer, please refer to the relevant promotional materials.

Learn more about BEA Wise (click here)

Preparation by: The Bank of East Asia, Limited

BEA Union Investment is not responsible for the publication of this material. Certain information contained in this material has been obtained from BEA Union Investment which has not been independently verified, although BEA Union Investment believes such information to be fair and not misleading. BEA Union Investment does not accept any liability whatsoever whether direct or indirect that may arise from the publication of this material by The Bank of East Asia Limited and use of information contained in this material. BEA Union Investment and its associates, directors, connected parties and/or employees may from time to time have interests and or underwriting commitments in the investments mentioned in this material. BEA Union Investment does not guarantee that all risks associated to the transactions mentioned herein have been identified, nor does it provide advice as to whether investors should enter into any such transaction. BEA Union Investment does not make any representation as to the merits, suitability, expected success, or profitability of any such transaction mentioned herein.

Investments in the Fund are subject to investment risks, including the possible loss of the principal amount invested. For full details and risk factors of the Fund, please refer to the explanatory memorandum of the Fund. Investors should also read the explanatory memorandum of the Fund for detailed information prior to any subscription. The information contained herein is only a brief introduction to the Fund. Investors should be aware that the price of units may go down as well as up, as the investments of the Fund are subject to market fluctuations and to the risks inherent in all investments. Past performance is not indicative of future performance.

The Fund has been authorised by the Securities and Futures Commission ("SFC") in Hong Kong. SFC authorisation is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material and website have not been reviewed by the SFC in Hong Kong.

Important Disclaimer:

Investment involves risks. The price of units may go down as well as up as the investments of a fund are subject to the market fluctuations and the risks inherent in investments. Past performance is not indicative of future performance. Investors should not make an investment decision based solely on this material.

Investment in emerging markets involves above-average investment risks, for instance, possible fluctuations in foreign exchange rates, political and economic uncertainties. It is possible that investors may lose some or the entire amount they have invested in the funds.

Before making any investment, investors should refer to all relevant investment funds' offering documents, including but not limited to the Explanatory Memorandum, for detailed information including the risk factors.

The information provided on this website is for reference only and does not constitute any offer, solicitation, invitation, opinion or recommendation to subscribe for or redeem any investment or securities.

The investment decision is yours but you should not invest in the investment funds unless the intermediary who sells it to you has explained to you that the investment funds are suitable for you having regard to your financial situation, investment experience and investment objectives.

The funds may not be available in all jurisdictions and may be subject to restrictions. If investors are in doubt, independent professional advice should be sought. This material has not been reviewed by the Securities and Futures Commission in Hong Kong.