- BEA (MPF) Master Trust Scheme, BEA (MPF) Value Scheme and BEA (MPF) Industry Scheme (collectively "BEA MPF") offer different Constituent Funds (i) investing in one or more approved pooled investment funds and/or approved index-tracking funds which invest in equities or bonds; or (ii) making direct investments. Each Constituent Fund has a different risk profile.

- The BEA (MPF) Conservative Fund under BEA (MPF) Master Trust Scheme, BEA MPF Conservative Fund under BEA (MPF) Value Scheme and BEA (Industry Scheme) MPF Conservative Fund under BEA (MPF) Industry Scheme do not provide any guarantee of the repayment of capital.

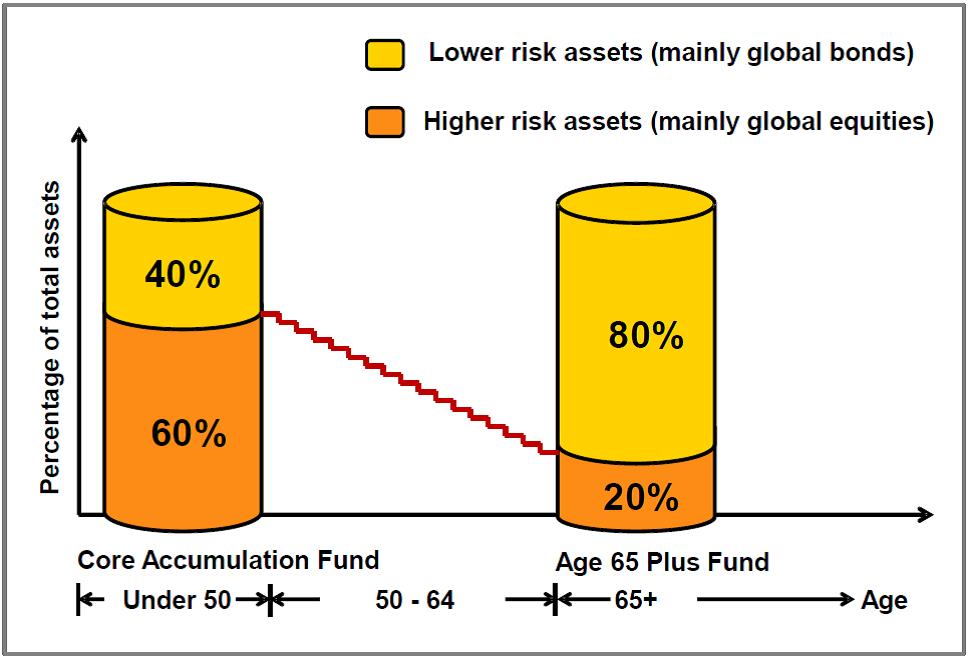

- You should consider your own risk tolerance level and financial circumstances before investing in the MPF default investment strategy ("DIS"). You should note that the BEA (MPF) Core Accumulation Fund and the BEA (MPF) Age 65 Plus Fund under BEA (MPF) Master Trust Scheme; the BEA Core Accumulation Fund and the BEA Age 65 Plus Fund under BEA (MPF) Value Scheme; and the BEA (Industry Scheme) Core Accumulation Fund and the BEA (Industry Scheme) Age 65 Plus Fund under BEA (MPF) Industry Scheme (collectively the "DIS Funds") may not be suitable for you, and there may be a risk mismatch between the DIS Funds and your risk profile (the resulting portfolio risk may be greater than your risk preference). You should seek financial and/or professional advice if you are in doubt as to whether the DIS is suitable for you, and make the investment decision most suitable for you taking into account your circumstances.

- You should note that the implementation of the DIS may have an impact on your MPF investments and accrued benefits. You should consult with the Trustee if you have doubts on how you are being affected.

- Investment involves risks. You should consider your own risk tolerance level and financial circumstances before making any investment choices. In your selection of Constituent Funds, if you are in doubt as to whether a certain Constituent Fund is suitable for you (including whether it is consistent with your investment objectives), you should seek financial and/or professional advice and choose the Constituent Fund(s) most suitable for you taking into account your circumstances.

- You should not invest based on this website alone. Investments inherently involve risk and the unit prices of the constituent funds may go down as well as up. Past performance of the constituent funds is not indicative of future performance. For further details including the product features, fees and charges, and the risk factors involved, please refer to the MPF Scheme Brochure of the relevant scheme.

- Important - If you are in doubt about the meaning or effect of the contents of the MPF Scheme Brochure, you should seek independent professional advice.

Personal Banking

- All-in-One Accounts

- SupremeGold Private

- SupremeGold

- Supreme

- BEA GOAL

Wealth Management

- Portfolio Management

- Provision of Professional Investment Management Services

- Market Outlook

- What's New

- BEA Wise

- BEA Financial Video

Wholesale Banking

- Everyday Banking

- Business Account

- Payment and Cash Management

- BEA Corporate Online

- Useful Information

- Application Forms and Bank Charges

Insurance, MPF & Trust

Investment

- East Asia Securities Cybertrading

- Online Stock Platform

- East Asia Futures Cybertrading

- Online Futures Platform

- Derivative Warrants / CBBC

- Online Warrants Platform

- FX/Precious Metal Margin Trading Services

- Product Information

- Latest Promotions

- Interest Rates

- FAQ