Equity Linked Investments

BEA distributes a wide range of equity linked investments, providing opportunities to gain enhanced returns based on the performance of a single or a basket of linked stock(s).

What is Equity Linked Investment?

Equity linked investment (“ELI”) is an unlisted structured investment product which is embedded with derivatives over a single or a basket of linked stock(s). Its investment return is linked to the performance of the reference asset(s) and depending on the terms of the ELI, maturity payoff will be made in cash or/and physical delivery of the linked single stock (for ELI linked with single stock, “Single ELI”) or the worst performing stock (for ELI linked with stock basket, “Basket ELI”) at the exercise price. |

|

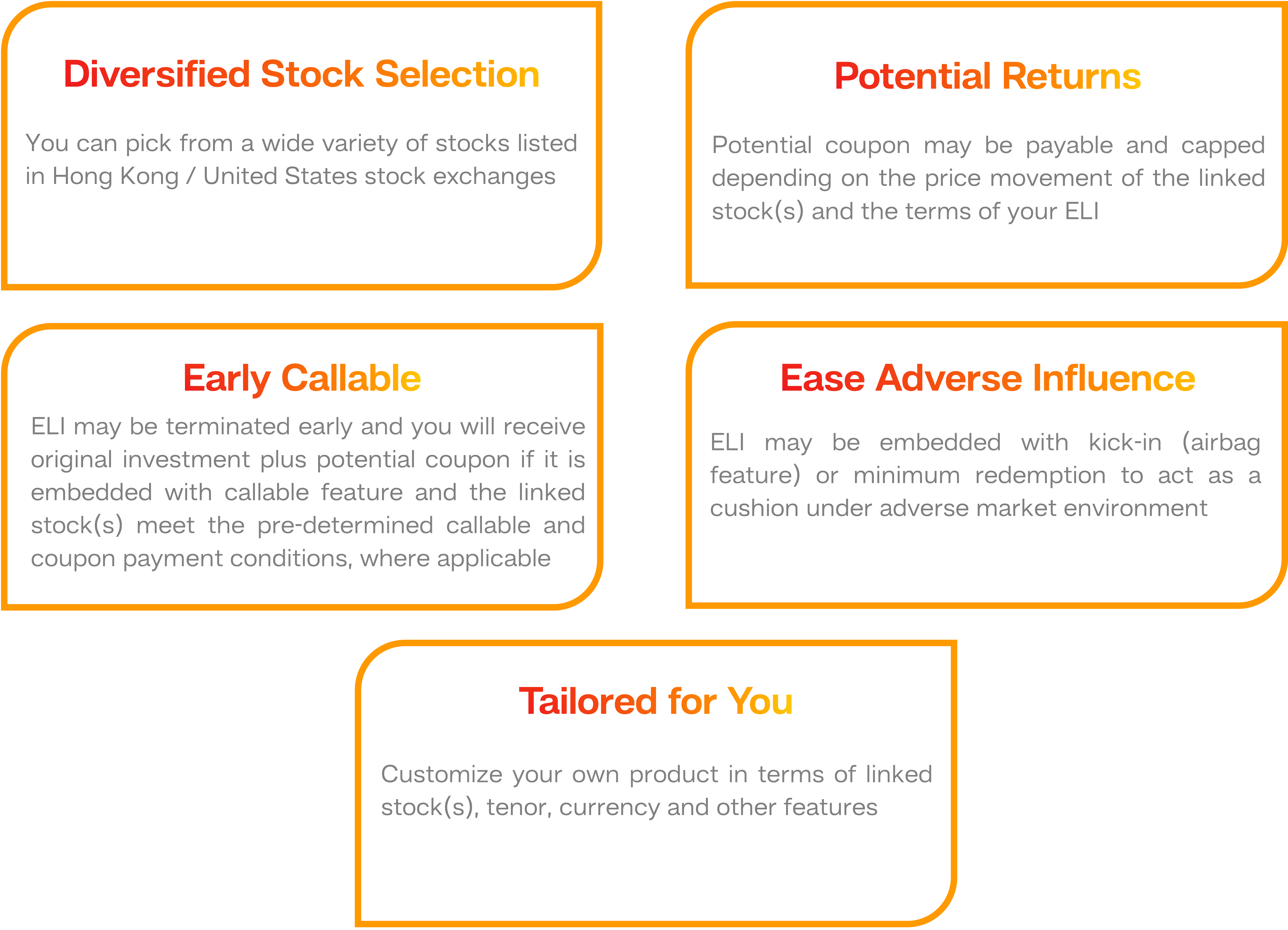

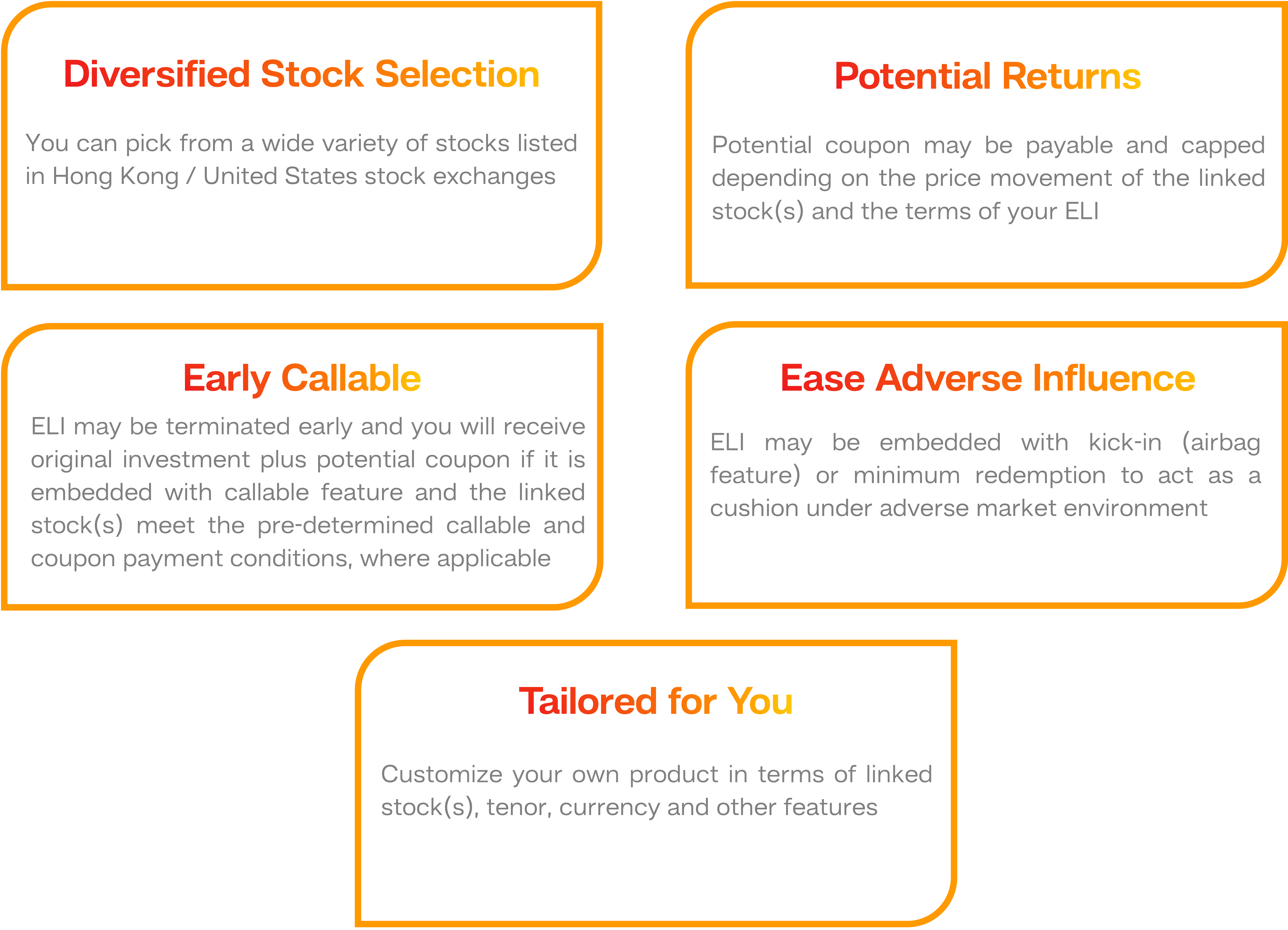

What are the key features of ELI?

Please note that the features above are examples for illustration purpose only and not meant to be exhaustive. Investment involves risks. For detailed product information and risk disclosures, please contact your relationship manager or visit our branches.

How does ELI works?

- Coupon: coupon may be in the form of fixed coupon (fixed percentage of nominal amount), variable coupon (coupon payable if the pre-determined condition(s) is satisfied), potential bonus enhancement coupon (coupon linking to the performance of the linked stock(s) as of expiry date) or in any other forms stated in the indicative term sheet of the ELI.

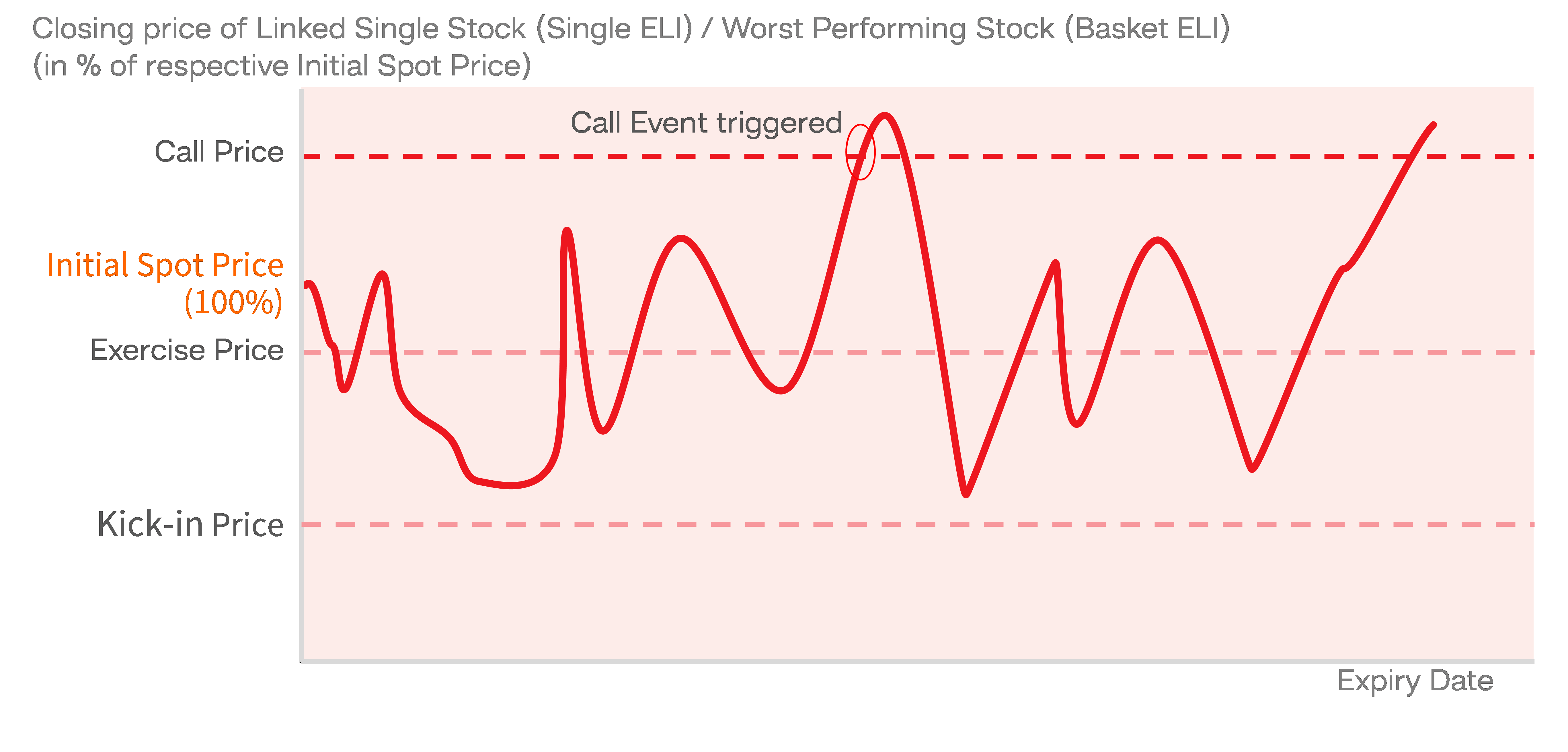

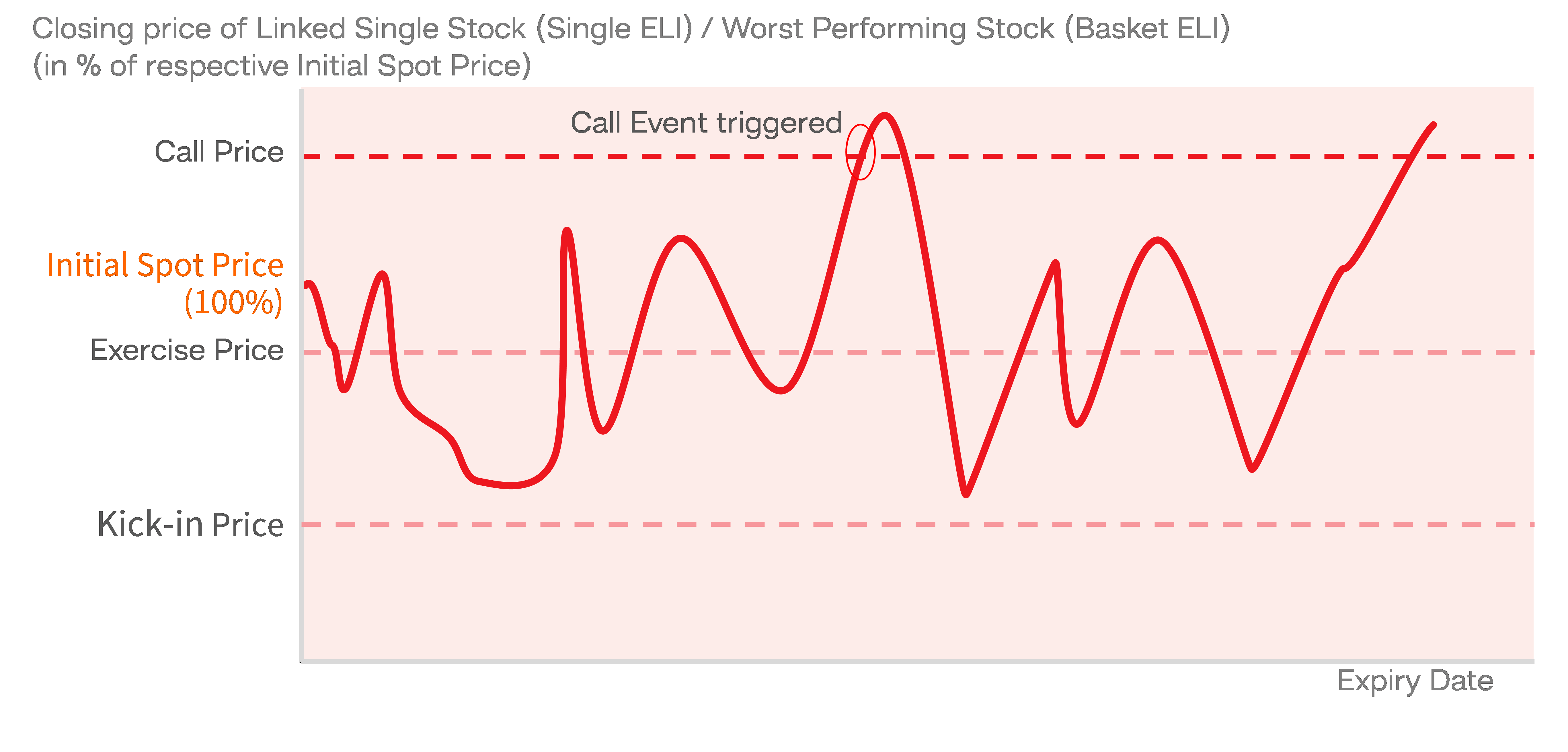

If the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) closes at or above the call price on the call date, call event is deemed to occur and the ELI will be terminated early. You will receive original investment amount plus potential coupon up to the call date. If no call event occurs, maturity payoff of the ELI will be determined based on whether it is embedded with kick-in / minimum redemption feature and the closing price of the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) as of the expiry date against its exercise price and initial spot price (if applicable).

If the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) closes at or above the call price on the call date, call event is deemed to occur and the ELI will be terminated early. You will receive original investment amount plus potential coupon up to the call date. If no call event occurs, maturity payoff of the ELI will be determined based on whether it is embedded with kick-in / minimum redemption feature and the closing price of the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) as of the expiry date against its exercise price and initial spot price (if applicable).

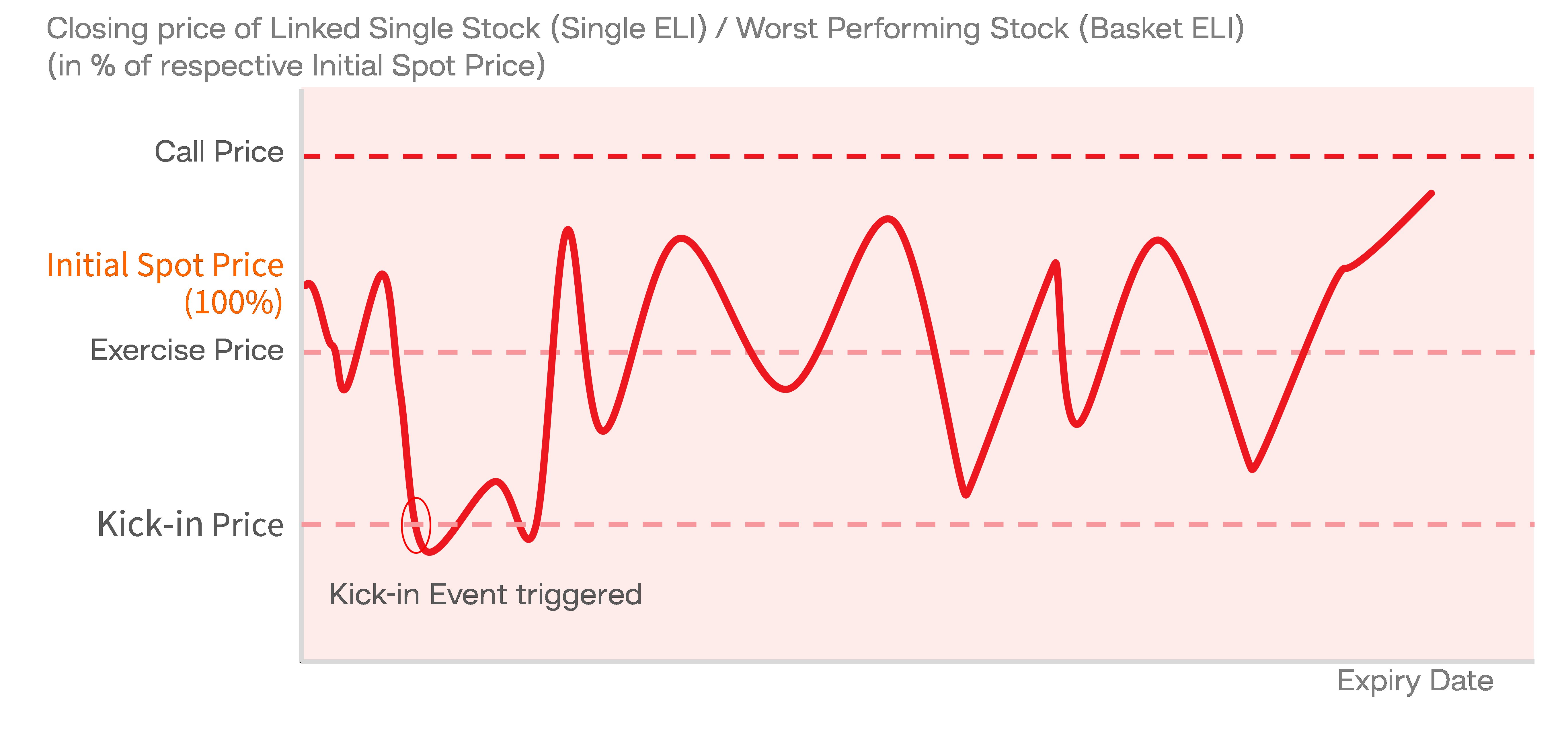

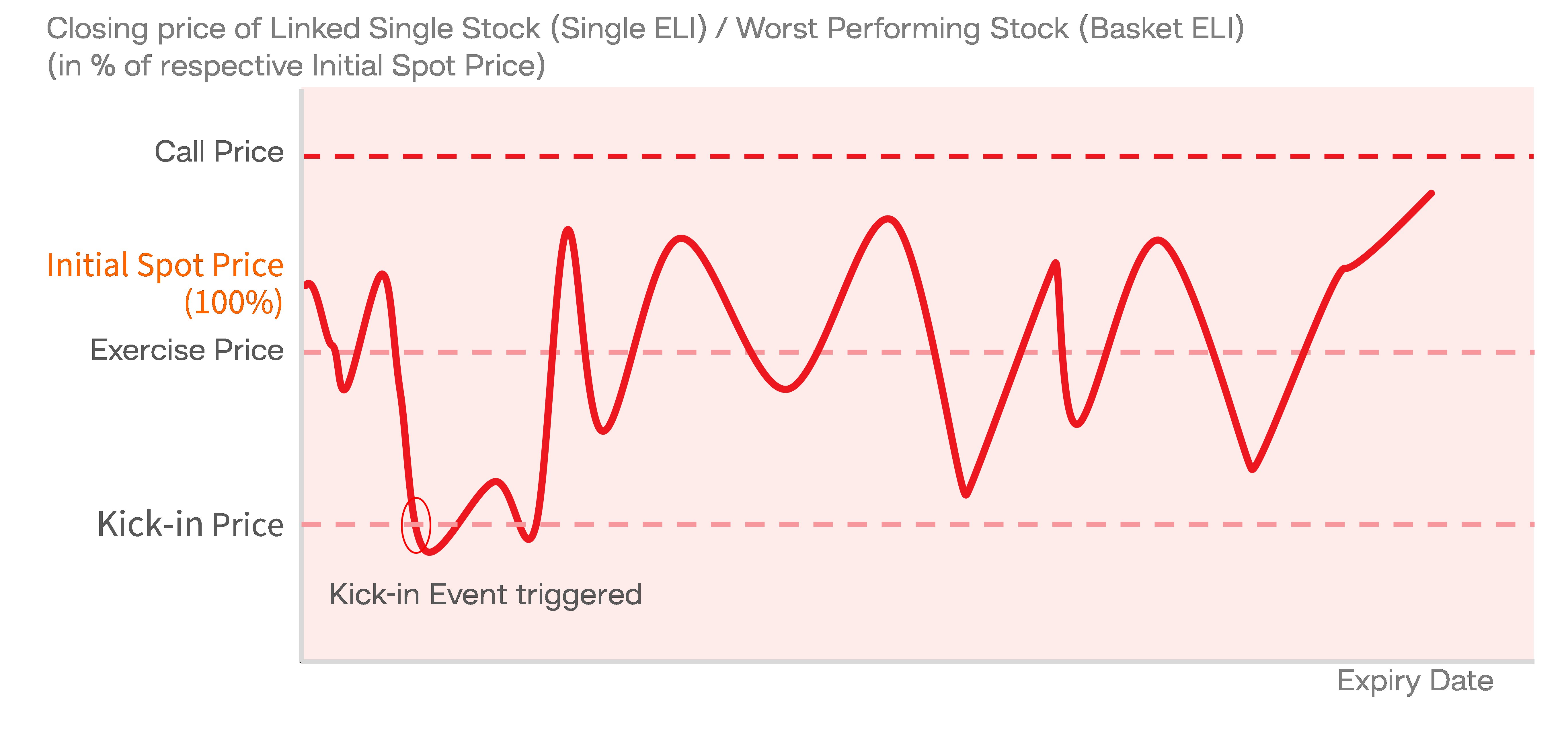

- Kick-in (airbag feature):

Kick-in event date may be either on each scheduled trading day or at the expiry date. If the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) closes below* the kick-in price on a kick-in event date, kick-in event is deemed to occur. If a kick-in event occurs, maturity payoff of the ELI will be determined based on the closing price of the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) as of the expiry date against its exercise price and initial spot price (if applicable) #. Otherwise, you will receive original investment amount plus potential coupon (if any) at maturity#.

Kick-in event date may be either on each scheduled trading day or at the expiry date. If the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) closes below* the kick-in price on a kick-in event date, kick-in event is deemed to occur. If a kick-in event occurs, maturity payoff of the ELI will be determined based on the closing price of the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) as of the expiry date against its exercise price and initial spot price (if applicable) #. Otherwise, you will receive original investment amount plus potential coupon (if any) at maturity#.

* In some ELIs, it will be “at or below”. Please refer to the indicative term sheet and the product booklet for details of each ELI.

# It is assumed that call event is not triggered.

- Minimum Redemption feature:

You can customize your ELI with a minimum redemption feature. Even though the closing price of the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) on the expiry date drops dramatically, you will receive your investment amount at a level of the minimum redemption price plus potential coupon (if any) at maturity. The potential maximum loss could then be capped.

You can customize your ELI with a minimum redemption feature. Even though the closing price of the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) on the expiry date drops dramatically, you will receive your investment amount at a level of the minimum redemption price plus potential coupon (if any) at maturity. The potential maximum loss could then be capped.

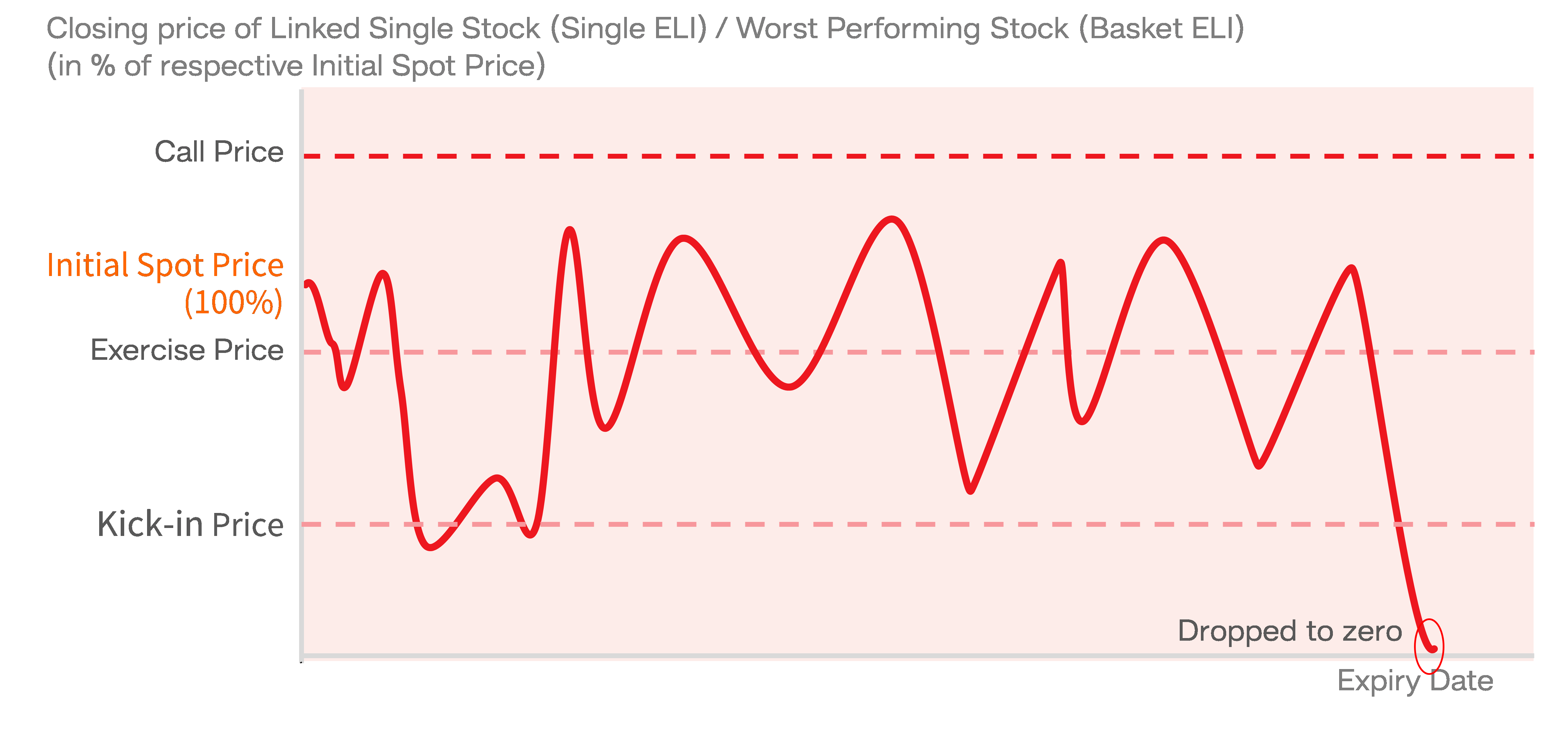

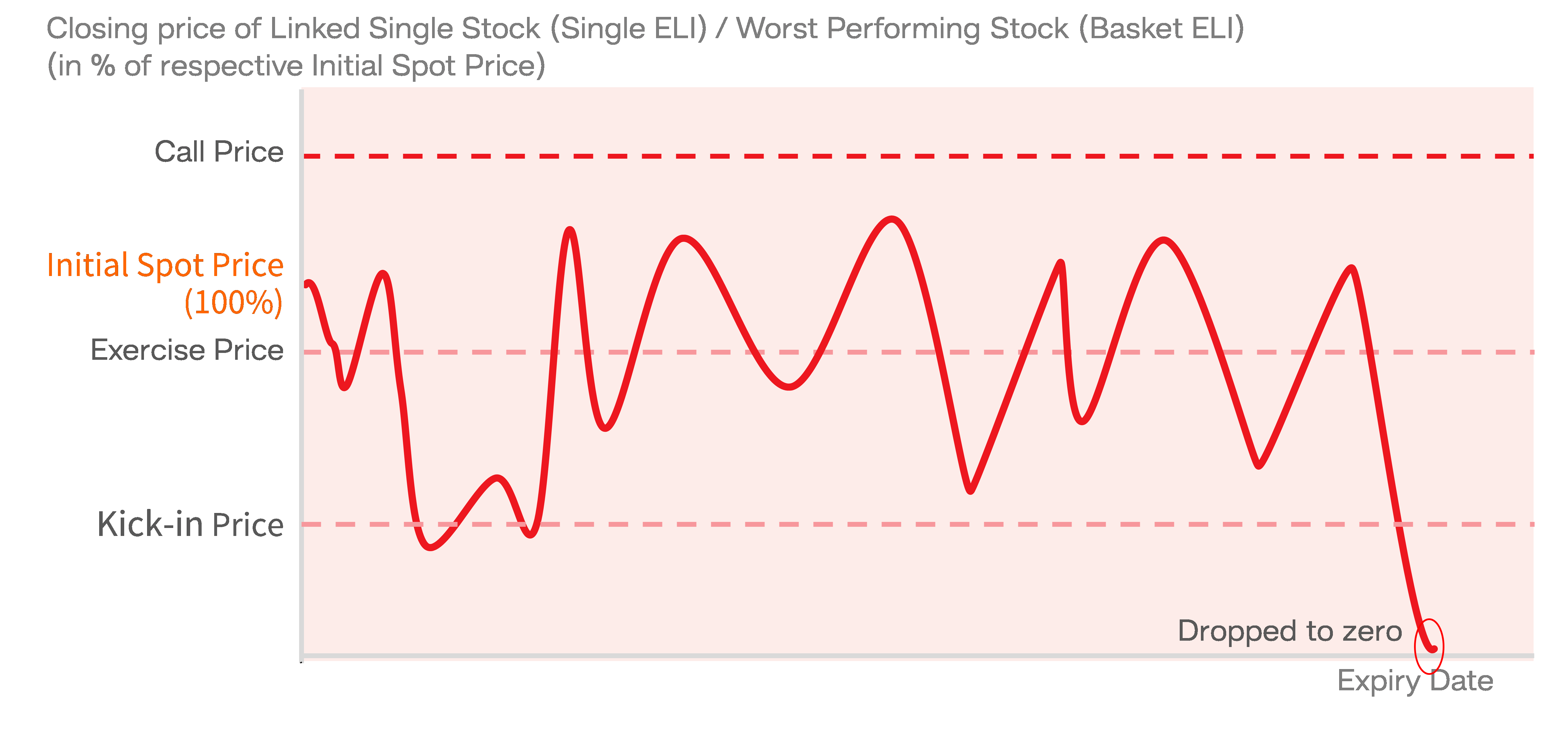

(a) in case there is physical delivery of the linked single stock (for Single ELI) or the worst performing stock (for Basket ELI) and the closing price of such stock drops to zero as of the expiry date, shares of such stock or cash equivalent of shares of such stock could be worth nothing. You would lose 100% of your initial investment amount.

(b) in case if ELI issuer becomes insolvent or defaults on its obligations under the ELI, you may get nothing back and the potential maximum loss could be 100% of your entire investment amount.

Remark:The above graphs assumed that the worst performing stock for Basket ELI is the same linked stock during the entire investment period. The graphs are provided for illustrative purpose only and do not reflect a complete analysis of all features and scenarios of the ELI . You should not rely on the illustrative graphs as an indication of or replication of the actual return under real investment conditions. Each ELI has its unique terms and features. You should read the indicative term sheet and the product booklet of the ELI for details. In the worst case, you could lose your entire investment amount.

Investment involves risks:

- The investment decision is yours and you should not invest in this product unless the intermediary sell it to you has explained to you that this product is suitable for you having regard to your financial situation, investment experience and investment objectives.

- Some Equity Linked Investment may not be capital protected and is subject to the performance and risks of the underlying assets, you could lose their entire investment as the underlying may become worthless in extreme cases.

- Some Equity Linked Investment may not have active secondary market, and may take longer time or impossible to sell to the market and may receive an amount which is substantially less than your original investment amount if you sell it or terminate it before maturity.

Important NoteInvestment involves risk. This page does not identify all the risks (direct or indirect) or other considerations, which might be material to you when entering into the transactions. Before entering into a transaction, you should ensure that you have sufficient knowledge and experience, and have received sufficient professional advice to make your own evaluation of the merits and risks of such a transaction. You should make sure you fully understand the risks associated with the relevant product and should also consider your own investment objectives and risk tolerance level. You should consult your own business, tax, legal, and/or accounting advisor(s) and refrain from entering into any transaction unless you have fully understood the associated risks and have independently determined that the transaction is appropriate for you.

This page and any indicative terms provided to you are solely for information purposes and do not constitute an offer, invitation or inducement or advice or recommendation on behalf of BEA to any person to buy or sell any security or investment product. The information and analysts contained in this page have been compiled or arrived at from sources believed to be reliable but BEA does not make any representation as to their accuracy or completeness and does not accept liability for any loss arising from the use hereof.

No representation or warranty is made that any indicative performance or return indicated will be achieved in the future. You are reminded that you are responsible for your investment decisions and should read the relevant offering documents and exercise of your own judgement. The advice or opinion expressed by BEA is based on certain assumptions.

This page has not been reviewed and authorized by any regulators.

This page serves as a generic description of the product. Individual products launched may come with variations to the basic structure. For further clarification on specific products, please contact your financial advisor or seek for independent advice.