- The investment decision is yours and you should not invest in this product unless the intermediary sell it to you has explained to you that this product is suitable for you having regard to your financial situation, investment experience and investment objectives.

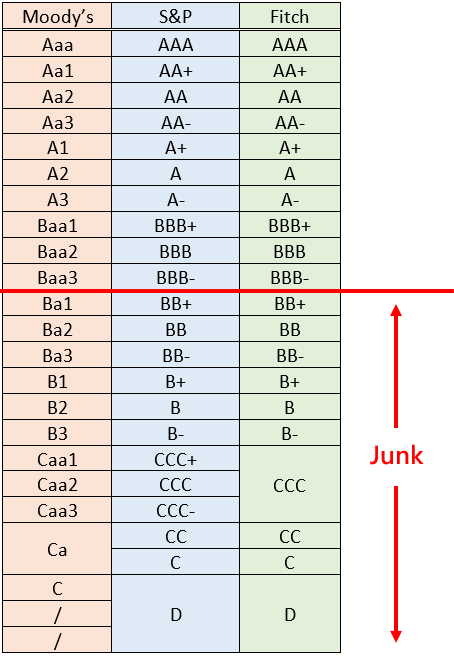

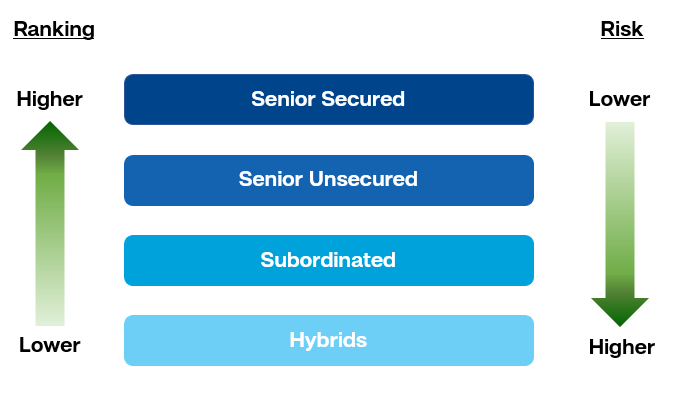

- There is a risk that the issuer may fail to pay the interest or principal to the product holders as scheduled.

- Price / return may be adversely affected by interest rate fluctuation.

- The longer the date to the bond’s maturity, the greater the risk that price will fluctuate due to greater chance that something might happen either in market conditions or to the bond’s issuer/guarantor to lessen the value of the bond.

- Some bonds may not have active secondary market, and may take longer time or impossible to sell to the market and may receive an amount which is substantially less than your original investment amount if you sell it before maturity.

Personal Banking

- All-in-One Accounts

- SupremeGold Private

- SupremeGold

- Supreme

- BEA GOAL

Wealth Management

- Portfolio Management

- Provision of Professional Investment Management Services

- Market Outlook

- What's New

- BEA Wise

- BEA Financial Video

Wholesale Banking

- Everyday Banking

- Business Account

- Payment and Cash Management

- BEA Corporate Online

- Useful Information

- Application Forms and Bank Charges

Insurance, MPF & Trust

Investment

- East Asia Securities Cybertrading

- Online Stock Platform

- East Asia Futures Cybertrading

- Online Futures Platform

- Derivative Warrants / CBBC

- Online Warrants Platform

- FX/Precious Metal Margin Trading Services

- Product Information

- Latest Promotions

- Interest Rates

- FAQ