Online Banking Platform Upgrade

Existing Corporate Cyberbanking users upgrade to BEA Corporate Online

Our brand new BEA Corporate Online platform has been launched earlier. All existing Corporate Cyberbanking customers will be automatically upgraded to the new platform gradually. The upgrade schedule of respective customers shall be determined by the Bank. Once the upgrade is completed, Corporate Cyberbanking will be demised.

Seamless upgrade experienceWe will notify you your upgrade schedule when it is your turn. You will then see a new login page. After logged in, you will be guided through a few easy steps to embark on your BEA Corporate Online journey.

Scheduled notifications & Customer service support

Corporate Cyberbanking users will receive prior notifications through Corporate Cyberbanking Message Box (the message icon on the right hand corner after logging into Corporate Cyberbanking) and registered emails with the below information:

Customer service supportIf you have any enquiries, please contact your relationship manager, or our service hotline at (852) 2211 1812 during office hours. (Office hours: Monday - Friday: 9:00 a.m. - 9:00 p.m. Saturday: 9:00 a.m. - 5:00 p.m.)

Manage your company's finance easier, faster with enhanced functions on BEA Corporate Online!Benefits at a glance

To know more about BEA Corporate Online - click here

Corporate Cyberbanking Online PIN Activation & PIN Reset Request

Your Corporate Cyberbanking PIN can be activated or reset whenever and wherever you need (no need for you to visit a branch)

Once your company email address and Authorised Person’s mobile phone number are registered for authentication, your Authorised Person can activate your PIN online by selecting "Activate PIN" in the Corporate Cyberbanking login page, or "Forgot PIN*" whenever you wish to reset it without visiting a branch. If any Authorised Person has not registered a mobile phone number with us, they can visit a BEA branch to register and apply for a new PIN.

* Applies to Administrator's Login PIN, Signing PIN, and Phone PIN only.

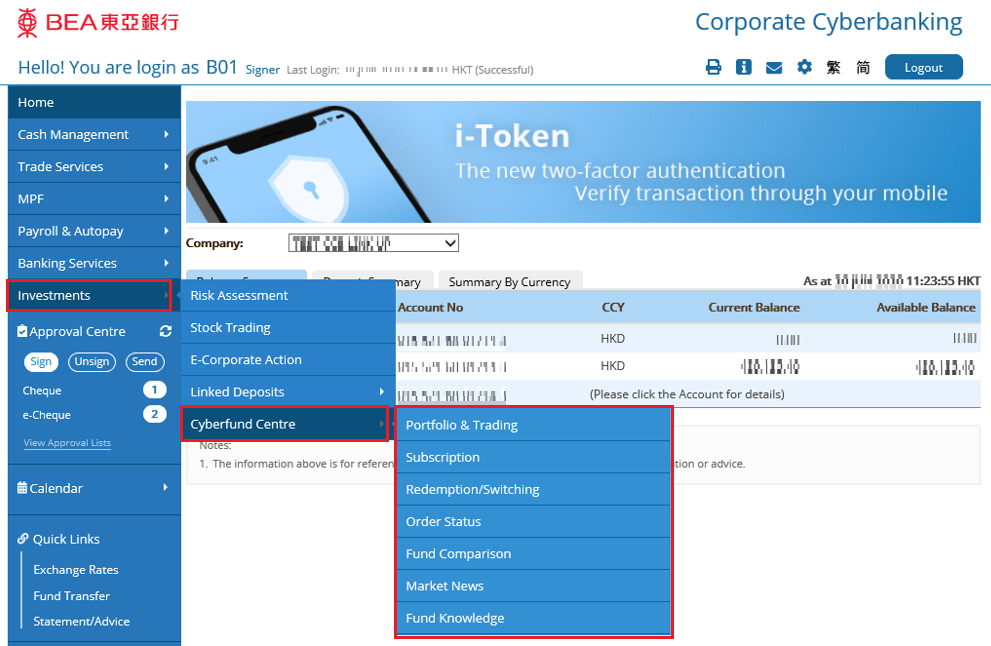

Launch of Corporate Cyberbanking (“CCB”) function - Cyberfund Centre

A brand new “Cyberfund Centre”

A brand new “Cyberfund Centre” service has been launched to CCB. With “Cyberfund Centre”, you can access the following functions:

- Fund portfolio and online trading

- Order status and transaction history enquiry

- Fund search and comparison

- Market news and fund knowledge

To access online trading function, you are required to:

1. hold a valid CorporatePlus Account with a CorporatePlus – Securities Account (hereinafter called “Securities Account”); and

2. authorise at least one CCB signer* to operate the Securities Account.*CCB signer who has been granted full function access to CCB on or before 23 August 2020 will be able to access the online trading functions automatically. If you would like to disable the user access right of the CCB signer, you may do so through User Maintenance – Function Access Profile (“FAP”) by your System Administrator at any time.

If you would like to apply for a Securities Account or change the setting for CCB signer(s), please contact your relationship manager or visit our branches.

Important Notes:

Investment involves risks. Before making any investment, you should refer to all relevant offering documents for detailed information, including the risk factors.

BEA Corporate Mobile App is available now! Please download and manage your corporate banking need at any time and place.

Corporate Cyberbanking & Corporate Mobile Banking - New Login Page Design

Corporate Cyberbanking

Corporate Cyberbanking has a new, more user-friendly login page. When you click on the “Personal Identification No. (‘PIN’)” field, an on-screen keyboard will appear underneath.

Corporate Mobile Banking

Corporate Mobile Banking also has a new login page, providing a smoother login experience.

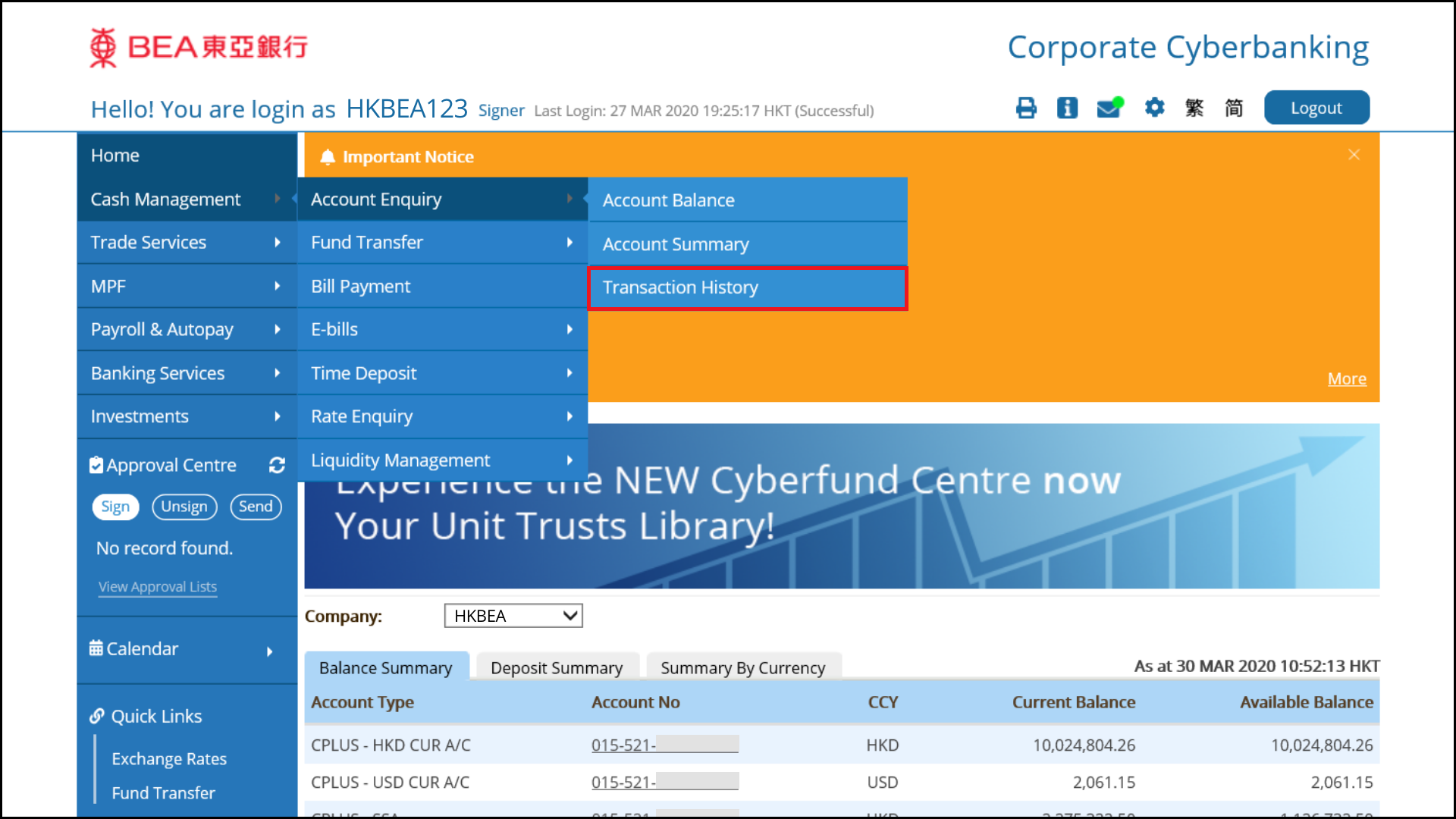

View Transaction History and Download Records

Transaction History and Download Records

To give you easier access to your account history, there are a number of updates to the “Account Enquiry” function in Cash Management:

- “History” and “Today’s Activity” functions have been combined into a single function named “Transaction History”.

- Transaction records can be downloaded in a CSV (.csv) file.

New Design of Corporate Cyberbanking Homepage

Corporate Cyberbanking Homepage

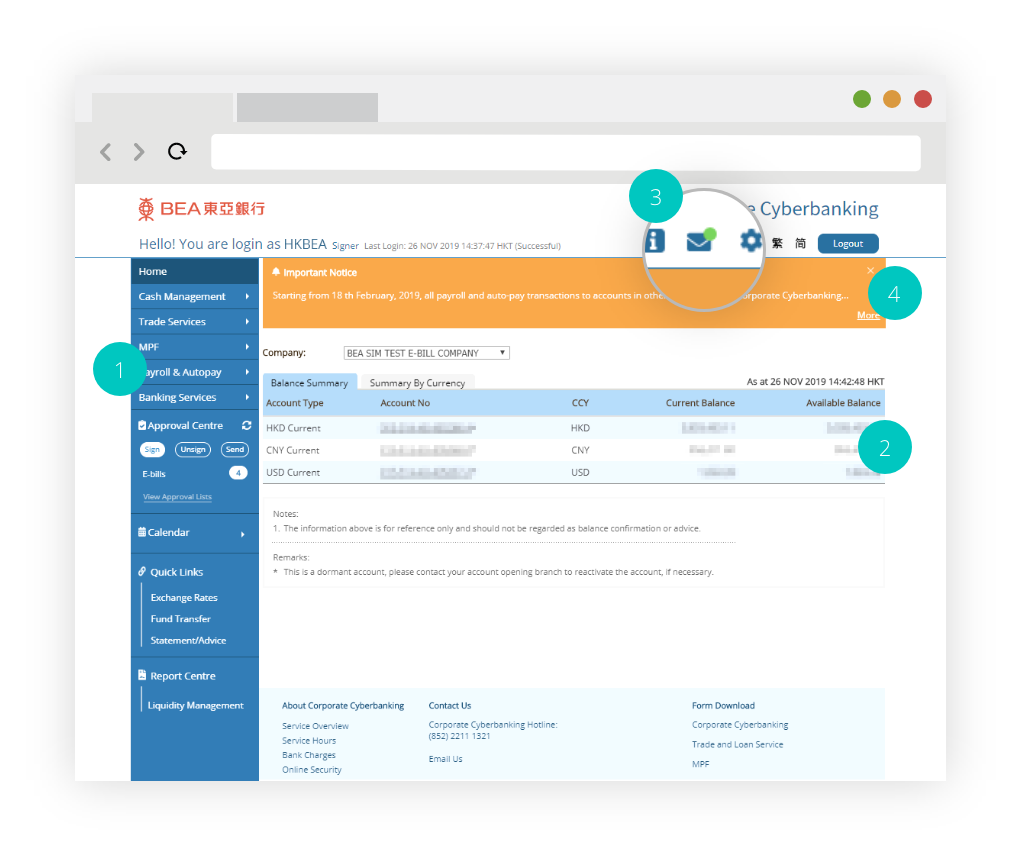

Our Corporate Cyberbanking homepage has been updated with a new design to improve your online banking experience.

The enhanced homepage includes a number of new features:

1. A handy navigation panel with an expandable calendar and quick-links for your convenience.

2. An all-in-one account overview of your Balance and Deposit summaries on the homepage.

3. Immediate access to Print, Information, Mailbox with notification badge, Language, and Settings.

4. A prominent Important Notice board showing the latest information and security updates.

Strengthened Security for Internet and Mobile Banking

Strengthened Security

To enhance your online security and provide a better customer experience, with effect from 16th July, 2018 (the Effective Date), the following changes will be made to Corporate Cyberbanking (CCB) – Internet and Mobile Banking:

1. Mobile Banking Login

Your existing Mobile Banking password will become invalid, and you will be required to use your CCB account number, User ID, and personal identification number (PIN) when you log in to Mobile Banking.

2. Internet Banking Login

You will be required to set a strong password which is at least 8 characters long and contains a mix of numbers and letters. If your existing PIN does not meet this strength, you will be prompted to update it when you first log in to CCB from the Effective Date onwards.

3. Email Notifications

You will receive an email notification at your registered email address for CCB when performing any of the activities below through CCB – Internet. If you have not registered your email address with the Bank, you will be required to provide an email address for receiving notifications when you perform any of the following activities through CCB from the Effective Date onwards:

- Log in to investment services1

- Perform investment transactions

- Reset your password

- Change your account information (e.g. company email address, signer’s email address and mobile phone number, etc.)

To register or update your mobile phone number or your email address for stock trading, please visit any of our branches.

1 Investment services include stocks and linked deposit-related services.