Important InformationThe brochure does not contain the full terms and conditions of the policy. It is not, and does not form part of, a contract of insurance and is designed to provide an overview of the key features of this product. The precise terms and conditions of this plan are specified in the policy contract. Please refer to the policy contract for the definitions of capitalised terms, and the exact and complete terms and conditions of cover. In case you want to read policy contract sample before making an application, you can obtain a copy from AIA. The brochure should be read along with the illustrative document (if any) and other relevant marketing materials, which include additional information and important considerations about this product. We would like to remind you to review the relevant product materials provided to you and seek independent professional advice if necessary.

This plan is an insurance plan without any savings element. All premiums are paid for the insurance and related costs.

This plan can be only purchased through Bank of East Asia as a basic plan.

This brochure is for distribution in Hong Kong only.

Key Product Risks

You need to pay the premium for this plan for life as long as you renew for this plan or for this add-on plan until the basic plan it is attached to is terminated. If you do not pay the premium within 31 days of the premium due date, the policy will be terminated and you / the insured will lose the cover.

- You may request for the termination of your policy by notifying us in written notice. Also, we will terminate your policy and you / the insured will lose the cover when one of the following happens:

• the insured passes away;

• you do not pay the premium within 31 days of the premium due date;

• the aggregate benefits under the relevant insurance policy reaches the overall lifetime limit; or;

•the aggregate benefits under the relevant insurance policy reaches the overall lifetime limit; or

If the insured happens to be hospitalised on the date when this plan / add-on plan is terminated because you do not pay the premium within 31 days of the premium due date, we will extend the cover for an additional 30 days without the need for you to make any payments, subject to the same benefit limits which apply to your original plan.

- We underwrite the plan and you are subject to our credit risk. If we are unable to satisfy the financial obligations of the policy, the insured may lose his cover and you may lose the remaining premium for that policy year.

- You are subject to exchange rate risks for plans denominated in currencies other than the local currency. Exchange rates fluctuate from time to time. You may suffer a loss of your benefit values and the subsequent premium payments (if any) may be higher than your initial premium payment as a result of exchange rate fluctuations. You should consider the exchange rate risks and decide whether to take such risks.

- The future medical costs will be higher than they are today due to inflation. Hence, the benefit amounts and the future premium rate of this plan may be revised to reflect the inflation (Please refer to Annual Premium Table for the first year premium provided by your financial planner).

Key Exclusions

Under this plan, we will not cover any of the following events or conditions:

- any treatment, investigation, service or supplies which is not medically necessary

- any pre-existing condition or congenital defect that appears or is diagnosed before the insured reaches the age of 17

- self-destruction, intentional self-inflicted injury or drug abuse

- war or warlike operations, and civil commotion, any violation or attempted violation of the law or resisting arrest, acts of terrorism for the insured is a terrorist, the use of atomic, biological or chemical weapons as well as radioactive, biological or chemical contamination due to any act of terrorism (except where the insured is injured during a trip outside the insured’s permanent residence country or place); or when the insured travels to a country at war, or where there is warlike operation, mutiny, riot, civil commotion, martial law or state of siege, or a war zone as recognised by the United Nations

- pregnancy, miscarriage, child birth, abortion, or related complications, except for "pregnancy complications benefit" (see benefits schedule, item 26 for details), AIDS or any complications associated with HIV infection, except for the "HIV / AIDS treatment benefit" (see benefits schedule, item 22 for details), mental or nervous disorder, except for the "mental or nervous disorder benefit" (see benefits schedule, item 23 for details)

- cosmetic or plastic surgery, dental care or surgery, except for the "routine dental treatment" under "Dental Benefits" (see benefits schedule, item 37 for details), corrective aids and treatments of refractive errors unless necessitated by injury caused by an accident, body check-up, except for the "vaccination and health check-up" under "Outpatient Benefits" (see benefits schedule, item 36 for details), gradual recovery of health or rest care

- consumption of any of the following traditional Chinese medicines, except for the "post-hospitalisation / day surgery ancillary benefit" and "stroke ancillary benefit" (see benefits schedule, items 18b and 25biii for details):

cordyceps 冬蟲夏草 / ganoderma 靈芝 / antler 鹿茸 / cubilose 燕窩 / donkey-hide gelatin 阿膠 / hippocampus 海馬 / ginseng 人參 / red ginseng 紅參 / American Ginseng 花旗參 / Radix Ginseng Silvestris 野山參 / antelope horn powder 羚羊角尖粉 / placenta hominis 紫河車 / Agaricus blazei murill 姫松 茸 / musk 麝香 / pearl powder 珍珠粉

The above list is for reference only. Please refer to the policy contract of this plan for the complete list and details of exclusions.

Premium Adjustment and Product Features Revision

1) Premium Adjustment

In order to provide you with continuous protection, we will review the premium of your plan from time to time and adjust it accordingly at the end of each renewal period if necessary. During the review, we may consider factors including but not limited to the following:

- claim costs incurred from all policies under this plan and the expected claim outgo in the future which reflects the impact of change in the incidence rate of death

- historical investment returns and the future outlook of the product’s backing asset

- policy surrenders and lapses

- expenses directly related to the policy and indirect expenses allocated to this product

2) Product Features

Revision We reserve the right to revise the benefit structure, terms and conditions and / or product features, so as to keep pace with the times for medical advancement and to provide you with continuous protection.

We will give you a written notice of any revision 31 days before the end of policy year or upon renewal.

Product Limitation

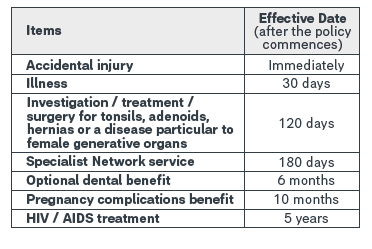

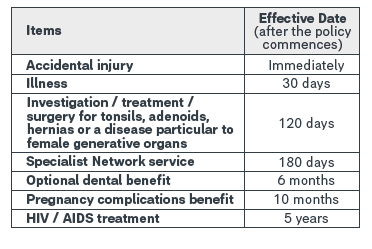

1) Cover for specific items will be effective on the following dates:

2) We only cover the charges and / or expenses of the insured on medically necessary and reasonable and customary basis.

"Medically necessary" means that the medical services, diagnosis and / or treatments are:

• delivered according to standards of good medicalpractice;

• necessary; and

• cannot be safely delivered in a lower level of medical care.

Experimental, screening, and preventive services or supplies are not considered medically necessary.

"Reasonable and customary" means:

• the medical services, diagnosis and / or treatments are medically necessary and delivered according to standards of good medical practice;

• the costs of your medical services and the duration of your hospital stay are not more expensive or longer than the usual level of charges or duration for similar treatment in the locality of such services delivered; and

• does not include charges that would not have been made if no insurance existed.

We may adjust any and all benefits payable in relation to any hospital / medical charges which is not a reasonable and customary charge.

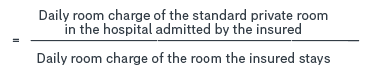

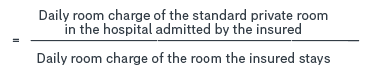

3) The insured will be covered for any room type in which he stays at hospital, but there will be a reduction in his benefit pay-out amount in case the insured stays in a room type higher than the plan covered. In such a case, the benefit pay-out amount will be adjusted by multiplying the following factor:

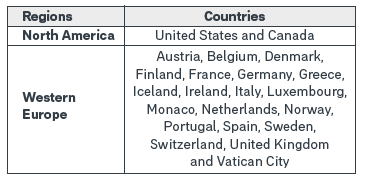

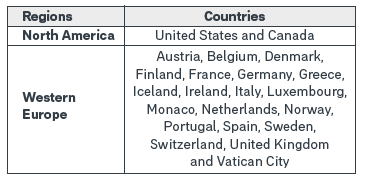

4) If the insured continuously stays for 365 days in one of the following regions, the medical services and / or treatments provided to the insured in such region will be permanently reduced to 60% of his benefit pay-out amount. Such reduction applies to all items in the benefits schedule except items 29 and 30:

5) If the eligible expenses have been reimbursed under any law, or medical program or other insurance policy provided by any government, company, other third party or us, such will not be reimbursable by us under this policy.

Incontestability.

6) Worldwide emergency assistance services are covered during the trip only (except for 24-hour worldwide telephone enquiring services), which are additional benefits. The services are provided by third party service provider(s). AIA shall not be responsible for any act, negligence or omission of medical advice, opinion, service or treatment on the part of them. AIA reserves the right to amend, suspend or terminate the service without further notice.

7) Medical network services, Credit Facility Service for Hospitalisation, and Medical Expense Pre-approval Service are additional benefits and do not form part of the contractual service. Medical network services are provided by network doctor. AIA shall not be responsible for any act or omission of network doctor in the provision of medical network services. Credit Facility Service for Hospitalisation is provided by third party service provider(s). AIA reserves the right to amend, suspend or terminate these services without further notice.

Claim Procedure

If you wish to make a claim, you must notify us in writing within 20 days of the date the covered event happened, and send us the appropriate forms and relevant proof within 90 days of the same date. You can get the appropriate claim forms from your financial planner, by calling the AIA Customer Hotline (852) 2232 8968 in Hong Kong, or by visiting any AIA Customer Service Centre. If you wish to know more about claim related matter, you may visit "File A Claim" section under our company website www.aia.com.hk.

Warning Statement and Cancellation Right

CEO Medical Plan 5 / CEO Medical Plan (Worldwide) 5 is an insurance plan without any savings element. All premiums are paid for the insurance and related costs. If you are not happy with your policy, you have a right to cancel it within the cooling-off period and obtain a refund of any premiums and levy paid. A written notice signed by you should be received by the Customer Service Centre of AIA International Limited at 12/F, AIA Tower, 183 Electric Road, North Point, Hong Kong within the cooling-off period (that is, 21 calendar days immediately following either the day of delivery of the policy or cooling-off notice (informing you / your nominated representative about the availability of the policy and expiry date of the cooling-off period, whichever is earlier). After the expiration of the cooling-off period, if you cancel the policy before the end of the term, you will not receive the refund of premiums paid.

Important Notes from the Insurance Agent of The Bank of East Asia, Limited

- The Bank of East Asia, Limited ("BEA"), being registered with the Insurance Authority as a licensed insurance agency, act as an appointed licensed insurance agent for AIA International Limited ("AIA"). This insurance plan is a product of AIA but not BEA.

- This insurance plan is underwritten by AIA and it is not a bank savings plan with free life insurance coverage. Part of the premium pays for the insurance and related costs. The premium paid is not a placement of a savings deposit with the bank and hence is not protected by the Deposit Protection Scheme in Hong Kong.

- Add-on plan (if any) is an add-on coverage for this insurance plan with additional premium paid required. BEA does not distribute any add-on plan; therefore, you cannot apply the add-on plan through BEA. If needed, you can contact AIA Customer Service Centre for inquiry after the policy is issued by AIA. For the avoidance of doubt, Super Lifestage Option is one of the product feature that offer you an option to purchase an additional term life insurance plan in the form of add-on plan without requiring further health information upon meeting the prescribed conditions and requirements (for details, please refer to the product brochure). However, you can only exercise the option by contacting AIA directly after the basic plan has been in force for two years and fulfilling the required conditions.

- In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between BEA and the customer out of the selling process or processing of the related transaction, BEA is required to enter into a Financial Dispute Resolution Scheme process with the customer.

- Claims under this insurance plan must be made by you to AIA directly. You can get the appropriate claim form by calling AIA Customer Service Hotline (852) 2232 8968 in Hong Kong or visiting www.aia.com.hk or any AIA Customer Service Centre. For details, please refer to the policy contract provided by AIA.

- BEA’s sales staff (including direct sales staff and authorised agents) are remunerated not only based on their financial performance, but also according to a range of other factors, including their adherence to best practices and their dedication to serving customers’ interests.

- The information you disclosed in response to all AIA’s questions must be true, complete and correct. Failure to disclose true, complete and correct information to AIA may render AIA unable to accept or process your application or the policy void.

- You are reminded to carefully review the relevant product materials provided to you and be advised to seek professional/ independent advice when considered necessary.

- For the benefits mentioned throughout the product brochure and Important Notes, please note that the policy owner is subject to the credit risk of AIA. If the policy owner discontinues and/or cancels this policy, he/she will not get back any of the premiums he/she has paid.