Underwritten by Blue Cross (Asia-Pacific) Insurance Limited

With the ever-increasing economic activity between China and Hong Kong, there is a growing need for emergency medical care in China among frequent travellers like you. China Access Pass provides you with year-round comprehensive protection and emergency assistance services. While travelling in Mainland China#, you can be admitted to one of over 200 network hospitals or medical units for immediate medical treatment. In the event of any emergency, simply present your China Emergency Medpass Card and you don't have to worry about paying hospital deposits.

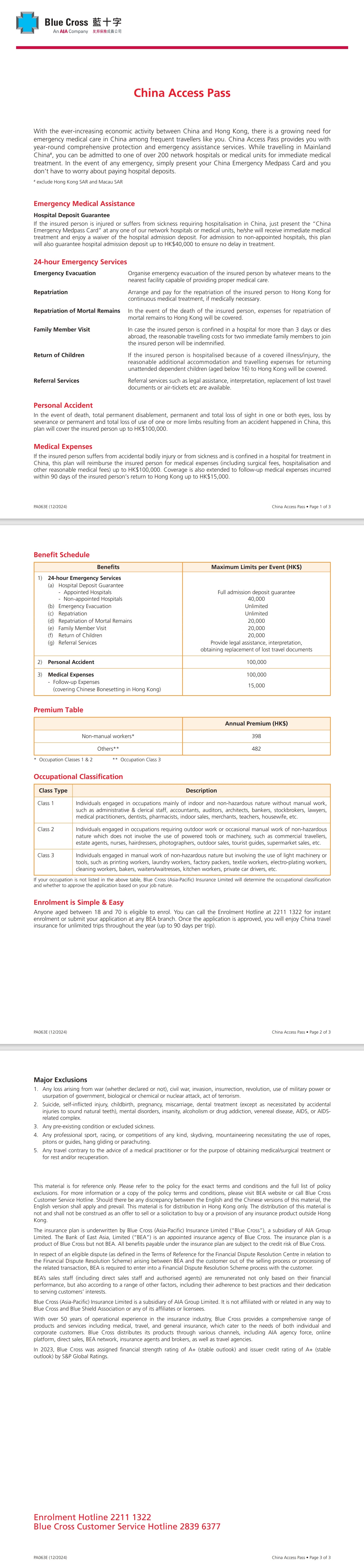

Emergency Medical AssistanceHospital Deposit Guarantee

If the insured person is injured or suffers from sickness requiring hospitalisation in China, just present the "China Emergency Medpass Card" at any one of our network hospitals or medical units, he/she will receive immediate medical treatment and enjoy a waiver of the hospital admission deposit. For admission to non-appointed hospitals, this plan will also guarantee hospital admission deposit up to HKD40,000 to ensure no delay in treatment.

24-hour Emergency Services

Organise emergency evacuation of the insured person by whatever means to the nearest facility capable of providing proper medical care.

Arrange and pay for the repatriation of the insured person to Hong Kong for continuous medical treatment, if medically necessary.

- Repatriation of Mortal Remains

In the event of the death of the insured person, expenses for repatriation of mortal remains to Hong Kong will be covered.

In case the insured person is confined in a hospital for more than 3 days or dies abroad, the reasonable travelling costs for two immediate family members to join the insured person will be indemnified.

If the insured person is hospitalised because of a covered illness / injury, the reasonable additional accommodation and travelling expenses for returning unattended dependent children (aged below 16) to Hong Kong will be covered.

Referral services such as legal assistance, interpretation, replacement of lost travel documents or air-tickets etc are available.

Personal Accident

In the event of death, total permanent disablement, permanent and total loss of sight in one or both eyes, loss by severance or permanent and total loss of use of one or more limbs resulting from an accident happened in China, this plan will cover the insured person up to HK$100,000.

Medical Expenses

If the insured person suffers from accidental bodily injury or from sickness and is confined in a hospital for treatment in China, this plan will reimburse the insured person for medical expenses (including surgical fees, hospitalisation and other reasonable medical fees) up to HKD100,000. Coverage is also extended to follow-up medical expenses incurred within 90 days of the insured person's return to Hong Kong up to HKD15,000.

Please refer to the Product Leafet for the details, benefits/ coverage, premium, major exclusion, important notes of the plan.

Major Exclusions

1.Any loss arising from war (whether declared or not), civil war, invasion, insurrection, revolution, use of military power or usurpation of government, biological or chemical or nuclear attack, act of terrorism.

2.Suicide, self-inflicted injury, childbirth, pregnancy, miscarriage, dental treatment (except as necessitated by accidental injuries to sound natural teeth), mental disorders, insanity, alcoholism or drug addiction, venereal disease, AIDS, or AIDS-related complex.

3.Any pre-existing condition or excluded sickness.

4.Any professional sport, racing, or competitions of any kind, skydiving, mountaineering necessitating the use of ropes, pitons or guides, hang gliding or parachuting.

5.Any travel contrary to the advice of a medical practitioner or for the purpose of obtaining medical / surgical treatment or for rest and / or recuperation.

Blue Cross Customer Service Hotline 2839 6377

This webpage is for reference only. Please refer to the policy for the exact terms and conditions and the full list of policy exclusions. Should there be any discrepancy between the English and the Chinese versions of this material, the English version shall apply and prevail. All insurance product information available on this website is not and shall not be construed as an offer to sell or a provision of insurance products to any person in any jurisdiction outside Hong Kong or a solicitation to such person to buy insurance products.

The insurance plan is underwritten by Blue Cross (Asia-Pacific) Insurance Limited (“Blue Cross”), a subsidiary of AIA Group Limited. The Bank of East Asia, Limited (“BEA”) is an appointed insurance agency of Blue Cross. The insurance plan is a product of Blue Cross but not BEA. All benefits payable under the insurance plan are subject to the credit risk of Blue Cross.

In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between BEA and the customer out of the selling process or processing of the related transaction, BEA is required to enter into a Financial Dispute Resolution Scheme process with the customer.

BEA’s sales staff (including direct sales staff and authorised agents) are remunerated not only based on their financial performance, but also according to a range of other factors, including their adherence to best practices and their dedication to serving customers’ interests.

Blue Cross (Asia-Pacific) Insurance Limited is a subsidiary of AIA Group Limited. It is not affiliated with or related in any way to Blue Cross and Blue Shield Association or any of its affiliates or licensees.