Life Insurance - Savings and Retirement Income

Underwritten by AIA International Limited (Incorporated in Bermuda with limited liability)

FLEXIBLE LEGACY PLANNING AND MULTI-CURRENCY OPTIONS

Global Power Multi-Currency Plan 2 offers up to 9 currency options so you can plan ahead and create the future for you and your family by exploring greater potential returns and capturing the global opportunities.

Flexible Currency Exchange Option for you to succeed in an ever-changing world

Enjoy long-term wealth accumulation and pass your legacy onto the generations to come while achieving financial freedom for you and your loved ones

Whether you are planning for your children’s education overseas or to create a steady legacy for the generations to come; preparing funds for your own retirement or moving abroad, Global Power Multi-Currency Plan 2 can help you seize global opportunities, allocate your assets flexibly and accumulate long-term wealth towards achieving your financial goals.

Global Power Multi-Currency Plan 2 paves the way towards your future and taps into opportunities to help you build stronger portfolios.

Open your world to new possibilities

Remarks:

1. Source: https://eduplus.hk/overseas/ and media news. A survey on overseas education expenditure conducted by GfK,which was commissioned by AIA (data collection date: April 2022)

2. Source: Education Bureau, “Secondary 6 Students’ Pathway Survey” for 2019, 2020 and 2021 (data collection: August 2022)

3. Source: AIA commissioned market research company KANTAR to conduct “Hong Kong and Macau Segmentation Study 2021”

4. Source: The 13th AIA Desired Retirement Tracker 2021

5. Source: https://www.numbeo.com (data collection date: August 2022)

6. Source: https://inews.hket.com/article/3232625/ (media news: April 2022)

Plan Highlights

Up to 9 policy currency options at inception for diversified planning

Global Power Multi-Currency Plan 2 is a participating whole-life insurance plan under the Global Power Series. It covers the entire lifespan of the insured (who is being protected under the policy). You can select from up to 9 currencies for your policy at inception, which include Renminbi (RMB), British pound sterling (GBP), US dollar (US$), Australian dollar (AUD), Canadian dollar (CAD), HK dollar (HK$), Macau pataca (MOP; only for policies issued in Macau), Euro (EUR) and Singapore dollar (SGD), each offering different policy returns.

Currency Exchange Option for accessing the advantages of global currencies

After the end of the 3rd policy year and within 30 days after the end of each policy year, through the Currency Exchange Option, you can change the policy currency to another currency as listed above. There will be no changes to the current policy effective date and the policy values will be recalculated and continue to accumulate based on the return of the new policy currency, helping you capture ever-evolving opportunities in a dynamic world while continuing to accumulate wealth with extra financial flexibility.

For more details on the Currency Exchange Option, please refer to “Cover at a glance” and “Key Product Risks” in this brochure.

# Macau pataca (MOP) is only available for policies issued in Macau.

Accumulate wealth with 4 premium payment term options

Global Power Multi-Currency Plan 2 can help you achieve guaranteed and potential gains. To suit your long-term wealth accumulation needs and your budget, you can choose a one-time premium payment term, a 3-year premium payment term (limited offer), a 5-year premium payment term or a 10-year premium payment term to help meet your different financial goals.

The plan helps accumulate wealth by offering guaranteed cash value and starting from the end of the 3rd policy year, it declares the non-guaranteed Reversionary Bonus and Terminal Bonus to your policy at least once per year.

Policy Split Option enables flexible asset allocation

After the end of the 3rd policy year or the end of the premium payment term, whichever is later, you can exercise the Policy Split Option according to your need and transfer certain policy values from the current policy to a separate policy, splitting one policy into two. The current policy will continue to be effective with no change in effective date, and the policy effective date of the split policy will be the same as the current policy.

You can apply for a change of policy currency and changeof insured after the policy is split. This flexibility allows you to allocate your assets strategically by holding multi-currency policies, helping to create the legacy you envision.

Bonus Lock-in Option andBonus Unlock Option cater to your evolving financial needs

Through the Bonus Lock-in Option, Global Power Multi-Currency Plan 2 enables you to realise potential returns by transferring the latest cash values of the Reversionary Bonus and Terminal Bonus into a Bonus Lock-in Account to earn interest at a non-guaranteed rate. This is available once per policy year, after the end of the 15th policy year and within 30 days after the end of each policy year.

To provide further flexibility for your financial needs throughout various life stages, you can withdraw cash from the Bonus Lock-in Account anytime without reducing the principal amount of your policy.

First-in-market Bonus Unlock Option

By exercising the Bonus Unlock Option, you can even unlock a certain amount of the latest value of the Bonus Lock-in Account as non-guaranteed Reversionary Bonus and Terminal Bonus to suit your financial needs. This is available once per policy year, starting from 1 year after bonus lock-in and within 30 days after the end of each policy year.

Withdraw cash flexibly to fulfil your changing needs

With Global Power Multi-Currency Plan 2, you can withdraw your policy values to realise your dreams. To address your changing needs in the future, upon request, you can withdraw part of the guaranteed cash value and the non-guaranteed cash values of the Reversionary Bonus and Terminal Bonus. However, this will reduce the future values of your policy. After withdrawal, the principal amount of the policy and the total premiums paid or one-time premium paid (as applicable) for the basic plan under the death benefit may be reduced.

Alternatively, you may choose to withdraw all cash values in the policy. Upon such withdrawal, you will receive the sum of the guaranteed cash value, non-guaranteed cash values of the Reversionary Bonus and Terminal Bonus, and any remaining balance of the Bonus Lock-in Account (if applicable), and your policy will be terminated.

Change of Insured Option and Contingent Insured Option add extra flexibility for you to pass on your legacy

During the lifetime of the current insured and after the end of the 1st policy year, the Change of Insured Option allows you to change the insured to another loved one as many times as you wish. That way, the value of your policy will not be affected and can be inherited by future generations, helping you pass on your wealth with extra flexibility.

With the Contingent Insured Option, during the lifetime of the current insured, you can designate one of your loved ones as the contingent insured. There is no limit on the number of times you can designate, modify or remove a contingent insured during the lifetime of the current insured. Upon the passing of the current insured, the contingent insured may become the new insured without affecting your policy values and your policy will continue to be effective, so as to protect your legacy for the generations to come.

Choose your settlement option topass on your assets to future generations as you wish

If the insured passes away and no contingent insured becomes the new insured, we will pay the death benefit to the person whom you select in your policy as beneficiary.

To ease your financial burden during unforeseen challenges, Global Power Multi-Currency Plan 2 offers extra protection through an accidental death benefit. This is paid in addition to the death benefit if the insured passes away due to a covered accident within the first year of the policy.

Apart from a lump-sum payment, you can customise the Death Benefit Settlement Option while the insured is still alive and allow your beneficiary to receive the death benefit and accidental death benefit in regular instalments. You can select not only the benefit amounts to be paid, but also the date of the first instalment payment of death benefit and accidental death benefit.

Extend premium payments

You may encounter an unexpected change that may cause an impact on your finances. Should one of the specified events happen to you during the premium payment term of the basic plan, you may claim for the Extension of Grace Period Benefit (not applicable to one-time premium payment). We will extend the grace period for late premium payment from 31 days to up to 365 days to give you extra financial flexibility while keeping the insured protected and the policy effective.

For more details of this benefit, please refer to “Cover at a glance” in this brochure.

Add-on cover for extra protection

You may select an add-on plan, under which we will waive the future premiums for Global Power Multi-Currency Plan 2 (not applicable to one-time premium payment) if the insured becomes totally and permanently disabled before the age of 60, providing support in the face of unfortunate circumstances.

In addition, you may also select the Payor Benefit Rider. Should you pass away or suffer total and permanent disability before the age of 60, we will waive the future premiums for the basic plan until the insured reaches the age of 25.

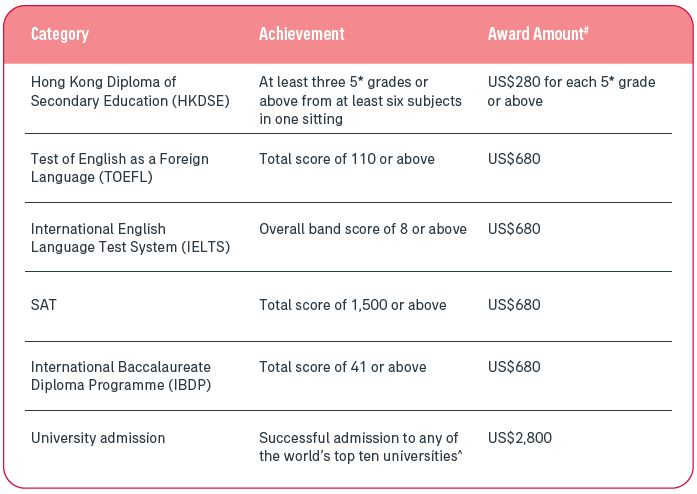

Rewards for academic excellence

To motivate the insured to strive for academic excellence, we will reward academic achievements by offering the Educational Merit Benefit. Once the policy has been in force for at least 1 year, if the insured obtains any one of the following achievements before the age of 25, Global Power Multi-Currency Plan 2 will pay the corresponding award amount while the policy is in force. The Educational Merit Benefit will only be paid for one of the following categories once per life under all Global Power Multi-Currency Plan 2 policies.

Educational Merit Benefit

# If the policy is issued in a currency other than US$, the award amount would be available in the respective policy currency and the prevailing exchange rate will be used to calculate the above amounts.

^ The ranking is based on a source as determined by us from time to time. For the latest details, please visit https://www.aia.com.hk/en/our-products/insurance-with-investment-focus/global-power-multi-currency-plan-2.html

Cover at a glance

| Premium Payment Term | One-time | 3-year (limited offer) | 5-year | 10-year |

| Insured’s Age at Application | 15 days to age 80 | 15 days to age 75 | 15 days to age 75 | 15 days to age 70 |

| Premium Payment Mode | Single premium | Annually / Semi-annually / Quarterly / Monthly | Annually / Semi-annually / Quarterly / Monthly | Annually / Semi-annually / Quarterly / Monthly |

| Benefit Term | Whole life | |||

|

Policy Currency and Minimum One-time / Annual Premium |

RMB 45,000 GBP 4,500 US$ 7,500 AUD 7,500 CAD 7,500 HK$ 56,250 MOP* 56,250 EUR 5,250 SGD 9,000 |

RMB 12,000 GBP 1,200 US$ 2,000 AUD 2,000 CAD 2,000 HK$ 15,000 MOP* 15,000 EUR 1,400 SGD 2,400 |

RMB 12,000 GBP 1,200 US$ 2,000 AUD 2,000 CAD 2,000 HK$ 15,000 MOP* 15,000 EUR 1,400 SGD 2,400 |

RMB 8,400 GBP 840 US$ 1,400 AUD 1,400 CAD 1,400 HK$ 10.500 MOP* 10.500 EUR 980 SGD 1,680 |

|

|

* Only for policies issued in Macau |

|||

| Principal Amount | For calculation of the premium and relevant policy values only and will not be payable as the death benefit. | |||

| Currency Exchange Option |

The Currency Exchange Option allows you to change your policy currency to another currency selected by you (including Renminbi (RMB), British pound sterling (GBP), US dollar (US$), Australian dollar (AUD), Canadian dollar (CAD), HK dollar (HK$), Macau pataca (MOP; only for policies issued in Macau), Euro (EUR) and Singapore dollar (SGD), by exchanging your plan (i.e. Global Power Multi-Currency Plan 2) to the latest plan under the Global Power Series in your designated policy currency, while maintaining the policy duration and without requiring a medical examination. Before you apply

Once your application is approved

|

|||

| Policy Split Option |

The Policy Split Option allows you to transfer certain policy values from the current policy to a separate policy (“Split Policy”) based on the split percentage requested by you while maintaining the policy duration and without requiring a medical examination. Before you apply

Once your application is approved

|

|||

| Non-Guaranteed Reversionary Bonus and Terminal Bonus |

The following non-guaranteed bonuses will be declared to your policy at least once per yearstarting from the end of the 3rd policy year: Reversionary Bonus

Terminal Bonus

|

|||

| Bonus Lock-in Option |

Within 30 days after the end of each policy year, starting from the end of the 15th policy year, you may apply to exercise the Bonus Lock-in Option once per policy year.

Value of the Bonus Lock-in Account

|

|||

| First-in-market Bonus Unlock Option |

Within 30 days after the end of each policy year, starting from 1 year after you have exercised the Bonus Lock-in Option, you may apply to exercise the Bonus Unlock Option once per policy year. Transfer into the Reversionary Bonus and Terminal Bonus

|

|||

| Surrender Benefit |

The surrender benefit will include:

We will deduct all outstanding debt under the policy before we make the payment. |

|||

| Change of Insured Option |

You may exercise the change of insured under the Change of Insured Option as many times as you wish, subject to our approval.

After the change of insured

|

|||

| Contingent Insured Option |

You may exercise the change of contingent insured under the Contingent Insured Option as many times as you wish, subject to our approval.

Upon the passing of the current insured

Upon the contingent insured becoming the new insured

|

|||

| Death Benefit |

The death benefit will include the higher of:

plus any remaining balance of the Bonus Lock-in Account (if applicable). |

|||

| Accidental Death Benefit |

In addition to the death benefit, if the insured passes away due to a covered accident within the first year of the policy, the accidental death benefit (in policy currency) will equal the total premiums paid or one-time premium paid (as applicable) for the basic plan. The maximum aggregate amount of the accidental death benefit with respect to the same insured under all Global Power Multi-Currency Plan 2 policies is RMB600,000 / GBP60,000 / US$100,000 / AUD100,000 / CAD100,000 / HK$750,000 / MOP750,000 / EUR70,000 / SGD120,000 and the benefit payable under each policy will be prorated according to its total premiums paid or one-time premium paid (as applicable) for the basic plan. |

|||

| Death Benefit Settlement Option |

|

|||

| Educational Merit Benefit |

|

|||

| Extension of Grace Period Benefit |

Please refer to the Note for Extension of Grace Period Benefit for further details. |

|||

| Add-on Cover |

|

|||

| Policy Loan |

|

|||

| Underwriting | No medical examination is required for your application as long as the total annual premiums or one-time premium payment (as applicable) does not exceed the aggregate limit set for each insured, subject to our prevailing rules and regulations. | |||

Important Information

This brochure does not contain the full terms and conditions of the policy. It is not, and does not form part of, a contract of insurance and is designed to provide an overview of the key features of this product. The precise terms and conditions of this plan are specified in the policy contract. Please refer to the policy contract for the definitions of capitalised terms, and the exact and complete terms and conditions of cover. In case you want to read policy contract sample before making anapplication, you can obtain a copy from AIA. This brochure should be read along with the illustrative document (if any) and other relevant marketing materials, which include additional information and important considerations about this product. We would like to remind you to review the relevant product materials provided to you and seek independent professional advice if necessary.

This plan can be only purchased through Bank of East Asia as a basic plan.

This brochure is for distribution in Hong Kong / Macau only.

Bonus Philosophy

This is a participating insurance plan in which we share a portion of the profits earned on it and related participating insurance plans with the policy owners. It is designed to be held long term. The premiums of a participating insurance plan will be invested in a variety of assets according to our investment strategy. The cost of policy benefits (including guaranteed and non-guaranteed benefits as specified in your plan that may be payable on death or surrender, as well as charges we make to support policy guarantees (if applicable)) and expenses will be deducted as appropriate from premiums of the participating insurance plan or from the invested assets. We aim to ensure a fair sharing of profits between policy owners and shareholders, and among different groups of policy owners.

Divisible surplus refers to profits available for distribution back to policy owners as determined by us. The divisible surplus that will be shared with policy owners will be based on the profits earned from your plan and related groups of similar plans or similar group of policies (as determined by us from time to time by considering factors such as benefit features, policy currencies and period of policy issuance), divisible surplus may be shared with the policy owners in the form of reversionary bonuses and terminal bonuses as specified in your policy.

We review and determine the bonus amounts payable to policy owners at least once per year. Divisible surplus depends on the investment performance of the assets which we invest in and the amounts of benefits and expenses we need to pay for the plan. It is therefore inherently uncertain. Nevertheless, we aim to deliver relatively stable bonus payments over time through a smoothing process by spreading out the gains and losses over a period of time. The actual bonuses declared may be different from those illustrated or projected in any insurance plan information provided (e.g. benefit illustrations) depending on whether the divisible surplus, past experience and / or outlook are different from what we expected. If bonuses are different, this will be reflected in the policy anniversary statement.

A committee has been set up to provide independent advice on the determination of the bonus amounts to the Board of the Company. The committee is comprised of members from different control functions or departments within the organisation both at the AIA Group level as well as Hong Kong local level, such as office of the Chief Executive of the Company, legal, compliance, finance, investment and risk management. Each member of the committee will endeavour to exercise due care, diligence and skill in the performance of his or her duties as a member. The committee will utilise the knowledge, experience, and perspectives of each individual member to assist the Board in the discharge of its duty to make independent decisions and to manage the risk of conflict of interests, in order to ensure fair treatment between policy owners and shareholders, and among different groups of policy owners. The actual bonuses, which are recommended by the Appointed Actuary, will be decided upon the deliberation of the committee and finally approved by the Board of Directors of the Company, including one or more Independent Non-Executive Directors, and with written declaration by the Chairman of the Board, an Independent Non-Executive Director and the Appointed Actuary on the management of fair treatment between policy owners and shareholders.

To determine the bonuses of a participating policy, we consider both past experience and the future outlook of all factors including, but not limited to, the following:

Investment returns: include interest earnings, dividends and any changes in the market value of the backing assets, i.e. the assets in which we invest your premiums (the cost of policy benefits and expenses will be deducted from the investment). Depending on the asset allocation adopted for the insurance plan, investment returns could be affected by fluctuations in interest income (both interest earnings and the outlook for interest rates) and various market risks, including interest rate risk, credit spread and default risk, fluctuations in listed and private equity prices, real estate prices as well as foreign exchange currency if the currency of the backing assets is different from the policy currency, etc.

Claims: include claims for death benefits and any other insured benefits under the insurance plan.

Surrenders: include policy surrenders, partial surrenders and policy lapses; and their corresponding impact on the backing assets.

Expenses: include both expenses directly related to the policy (e.g. commission, underwriting, issue and premium collection expenses) and indirect expenses allocated to the insurance plan (e.g. general administrative costs).

Some participating insurance plans (if applicable) allow the policy owners to place their annual dividends, guaranteed and non-guaranteed cash payments, guaranteed and non-guaranteed incomes, guaranteed and non-guaranteed annuity payments, and / or bonus and terminal dividend lock-in accounts with us, potentially earning interest at a non-guaranteed interest rate. To determine such non-guaranteed interest rate, we consider the returns on the pool of assets in which these amounts are invested with reference to the past experience and future outlook. This pool of assets is segregated from other investments of the Company and may include bonds and other fixed income instruments.

For bonus philosophy and bonus history, please visit our website at https://www.aia.com.hk/en/dividend-philosophy-history.html

Investment Philosophy, Objective and Strategy

Our investment philosophy aims to deliver sustainable long-term returns in line with the insurance plan’s investment objectives and the Company’s business and financial objectives.

Our aforementioned objectives are to achieve the targeted long-term investment results while minimising volatility in investment returns to support the liabilities over time. They also aim to control and diversify risk exposures, maintain adequate liquidity and manage the assets with respect to the liabilities.

Our current long-term target strategy is to allocate assets attributed to this insurance plan as follows:

| Asset Class | Target Asset Mix |

| Bonds and other fixed income instruments | 25% 100% |

| Growth assets | 0% - 75% |

The bonds and other fixed income instruments predominantly include government and corporate bonds and are mainly invested in the United States, Canada, the United Kingdom and Asia-Pacific. Growth assets may include listed equity, equity mutual funds, physical real estate, real estate funds, private equity funds and private credit funds, and are mainly invested in the United States, Asia-Pacific and Europe. Growth assets generally have a higher long-term expected return than bonds and fixed income assets but may be more volatile in the short term. The range of target asset mix may be different for different participating insurance plans. Our investment strategy is to actively manage the investment portfolio i.e. adjust the asset mix in response to the external market conditions and the financial condition of the participating business. For example, there is a smaller proportion of growth assets when interest rates are low and a larger proportion of growth assets when interest rates are high. When interest rates are low, the proportion of growth assets may be even smaller than the long-term target strategy, so as to allow us to minimise volatility in investment returns and to protect our ability to pay the guaranteed benefits under the insurance plans, whereas the proportion of the growth assets may be even larger than the long-term target strategy when interest rates are high to allow for the possibility that we may share more investment opportunities in growth assets with the policy owners.

Subject to our investment objectives, we may use a material amount of derivatives to manage our investment risk exposure and for matching between assets and liabilities, for example, the effects of changes in interest rates may be moderated, while allowing for more flexibility in asset allocation.

Our currency strategy is to minimise currency mismatches. For bonds or other fixed income instruments, our current practice is to endeavour to currency-match bond purchases with the currency of the underlying policy (e.g. US Dollar assets will be used to back US Dollar insurance plans). Subject to market availability and opportunity, bonds may be invested in a currency other than the currency of the underlying policy and currency swaps may be used to minimise the currency risks. Currently assets are mainly invested in US dollars / the denominated currency. Growth assets may be invested in a currency other than the currency of the underlying policy and the selection is done according to our investment philosophy, investment objectives and mandate.

We will pool the investments from similar participating insurance plans to determine the return and we will allocate the return to specific participating insurance plans with reference to their target asset mix. Actual investments (e.g. geographical mix, currency mix) would depend on market opportunities at the time of purchase, hence may differ from the target asset mix.

The investment strategy is subject to change depending on the market conditions and economic outlook. Should there be any material changes in the investment strategy, we will inform policy owners of the changes, with underlying reasons and expected impact to the bonuses.

Key Product Risks

- You should pay premium(s) on time and according to the selected premium payment schedule. If you stop paying the premium before completion of the premium payment term, you may surrender the policy, otherwise, the premium will be covered by a loan taken out on the policy automatically. When the loan balance exceeds the sum of guaranteed cash value and cash value of Reversionary Bonus (if any) of the basic plan, the policy will be terminated and you will lose the cover. The surrender value of the policy will be used to repay the loan balance, and we will refund any remaining value.

- The plan may make certain portion of its investment in growth assets. Returns of growth assets are generally more volatile than bonds and other fixed income instruments, you should note the target asset mix of the product as disclosed in this product brochure, which will affect the bonus on the product. The savings component of the plan is subject to risks and possible loss. Should you surrender the policy early, you may receive an amount considerably less than the total amount of premiums paid.

- For one-time premium payment policy, they are subject to higher investment return volatility and thus are expected to have higher volatility on the bonuses payable, as compared to policies with a 3-year premium payment term, a 5-year premium payment term or a 10-year premium payment term which can benefit from cost averaging effect.

-

You may request for the termination of your policy by notifying us in written notice. Also, we will terminate your policy and you / the insured will lose the cover when one of the following happens:

• the insured passes away, except when the contingent insured becomes the new insured;

• you do not pay the premium within 31 days (or up to 365 days under the Extension of Grace Period Benefit) of the due date and the policy has no cash value (only applicable for a 3-year premium payment, a 5-year premium payment or a 10-yearpremium payment policy); or

• the outstanding debt exceeds the guaranteed cash value plus the non-guaranteed cash value of the Reversionary Bonus (if any) of the policy. - We underwrite the plan and you are subject to our credit risk. If we are unable to satisfy the financial obligations of the policy, you may lose your premium paid and benefits.

- You are subject to exchange rate risks for plans denominated in currencies other than the localcurrency. Exchange rates fluctuate from time to time. You may suffer a loss of your benefit values and the subsequent premium payments (if any) may behigher than your initial premium payment as a result of exchange rate fluctuations. You should consider the exchange rate risks and decide whether to take such risks.

-

In case the policy currency is changed under the Currency Exchange Option, by exchanging your plan (i.e. Global Power Multi-Currency Plan 2) to the latest plan under the Global Power Series at the time of when you exercise the option, the adjustments on policy value may be significant (either positive or negative) and the amount of policy value after exercising the Currency Exchange Option may be considerably less than the total amount of premiums paid. Any future premiums will be adjusted if the Currency Exchange Option is exercised within the premium payment term. The approval of Currency Exchange Option's application and the availability of currency at the time of exercising the Currency Exchange Option will be subject to the prevailing laws and regulations.

Please note that there could be a material difference between your plan and the latest plan available under the Global Power Series at the time when you exercise the Currency Exchange Option. Material difference includes but not limited to:

• product features (i.e. benefits, policy terms and conditions, investment strategy, target asset mix and relevant investment return and limitation); and

• the availability of Currency Exchange Option, and in a worst case scenario, it may only be a one-time option under your plan depending on the future new plan’s features.You shall not purchase this product solely for the Currency Exchange Option.

Please carefully evaluate the difference between the current plan and the latest plan under the Global Power Series available for exchange when you exercise the Currency Exchange Option and consider whether the latest plan suits your needs.

- When applying for the Bonus Unlock Option, a newbenefit illustration must be signed and the application cannot be withdrawn once submitted. After exercising the Bonus Unlock Option, the unlocked part will be subject to the risk of higher investment return volatility because the latest value in the Bonus Lock-in Account will be unlocked as non-guaranteed Reversionary Bonus and Terminal Bonus. The cash value of Reversionary Bonus, cash value and face value of Terminal Bonus may be adjusted over our declarations at least once per year and amount in each declaration may be greater or less than the previous amount based on a number of factors, including but not limited to investment returns and general market volatility. Even if you are dissatisfied with the investment return after exercising the Bonus Unlock Option, the unlock amount which is transferred as Reversionary Bonus and Terminal Bonus cannot be reversed to the original value under the Bonus Lock-in Account. You mayapply for the Bonus Lock-in Option again at least 1 year later and such action cannot offset any loss you may suffer after exercising the Bonus Unlock Option.

- Your current planned benefit may not be sufficient to meet your future needs since the future cost of living may become higher than they are today due to inflation. Where the actual rate of inflation is higher than expected, you may receive less in real terms even if we meet all of our contractual obligations.

- As the cash value of Reversionary Bonus is non-guaranteed, there may be a risk of overloan when there is adjustment on the cash value of Reversionary Bonus. Loan repayment within one month is required when there is an overloan,otherwise your policy will be terminated and you or the insured may lose the cover.

- The total IRR and projected breakeven year illustrated in this brochure are non-guaranteed and are based on the Company's bonus scales determined under current assumed investment return. The actual total IRR and projected breakeven year may be based on several factors (including but not limited to investment returns, expenses, claims, surrenders, timing and frequency of exercising the Currency Exchange Option and Bonus Unlock Option) and may be less favourable or longer (as the case maybe) than those illustrated. In the worst scenario, the actual total IRR can be equal to the guaranteed IRR. There can be variance for IRR and breakeven year under different premium payment term, policy currency options and different plans under the Global Power Series since they are totally independent. For IRR and breakeven year of Global Power Multi-Currency Plan 2 policies with different plan options, please refer to relevant benefit illustrations. The total IRR of Global Power Multi-Currency Plan 2 for specific policy currency is not indicative of future performance of future plans under the Global Power Series.

Key Exclusions to Accidental Death Benefit

Accidental Death Benefit will not cover any conditions that result from any of the following:

- self-destruction while sane or insane, participation ina fight or affray, being under the influence of alcohol

or a non-prescribed drug - war, service in armed forces in time of war or restoration of public order, riot, industrial action,terrorist activity, violation or attempted violation of the law or resistance to arrest

- racing on wheels or horse, scuba diving

- ptomaines or bacterial infection (except pyogenicinfection occurring through an accidental cut orwound)

- air travel, including entering, exiting, operating,servicing or being transported by any aerial device or conveyance (except as a passenger of a commercial passenger airline on a regular scheduled passenger trip over its established passenger route)

The above list is for reference only. Please refer to thepolicy contract of this plan for the complete list and details of exclusions.

Note for Extension of Grace Period Benefit

The Extension of Grace Period Benefit will cease on the earliest of the following dates:

- at the end of extended grace period,

- in the case of Involuntary Unemployment, you fail toprovide proof of continuous status of unemployment upon our request,

- the date on which the policy owner has been changed,

- the date on which any claims on waiver of premium under your basic plan is approved,

- at the end of premium payment term of your basic plan,

- the date when any withdrawals or claims of your basic plan and / or add-on plans is made, if the premium payment mode after the payment of benefits is not monthly, and,

- the date when you pay all outstanding premiums.

In the case of Involuntary Unemployment under the Extension of Grace Period Benefit, you must be employed under a continuous contract for not less than 24 months and be eligible for a severance payment upon termination under the employment or labour laws of Hong Kong or Macau (according to the place of policy issuance) prior to the involuntary unemployment. Further, such employment cannot be self-employment, employment by a family member (including spouse, parent, grandparent, child or grandchild) or employment as a domestic servant. The Extension of Grace Period Benefit starts on the premium due date at the time when we approve your claim and continues for up to 365 days. Proof of continuous unemployment is required by you upon our request. The Extension of Grace Period Benefit is not available if you were informed of your pending involuntary unemployment on or before the issue date or commencement date of the policy, whichever is later.

Claim for Extension of Grace Period Benefit must be submitted within the specific time.

The Extension of Grace Period Benefit could only be claimed once per policy and relevant proof is required. The approval of the Extension of Grace Period Benefit is subject to our prevailing rules and regulations, and the handling of policy during the extended grace period will be subject to our discretion.

Claim Procedure

If you wish to make a claim, you must send us the appropriate forms and relevant proof. You can get the appropriate claim forms in www.aia.com.hk, from your financial planner, by calling the AIA Customer Hotline (852) 2232 8968 in Hong Kong, or by visiting any AIA Customer Service Centre. For details related to making a claim, please refer to the policy contract. If you wish to know more about claim related matter, you may visit “File A Claim” section under our company website www.aia.com.hk.

Suicide

Incontestability

Except for fraud or non-payment of premiums, we will not contest the validity of this policy after it has been in force during the lifetime of the insured for a continuous period of two years from the date on which the policy takes effect. This provision does not apply to any add-on plan providing accident, hospitalisation or disability benefits. After exercising the Change of Insured Option or upon the contingent insured becoming the new insured, such two-year period will be counted again starting from the effective date of change as recorded by us.

Warning Statement and Cancellation Right (Applicable to principal policy)

Global Power Multi-Currency Plan 2 is an insurance plan with a savings element. Part of the premium pays for the insurance and related costs. If you are not happy with your policy, you have a right to cancel it within the cooling-off period and obtain a refund of any premiums and levy paid. A written notice signed by you should be received by the Customer Service Centre of AIA International Limited at 12/F, AIA Tower, 183 Electric Road, North Point, Hong Kong within the cooling-off period (that is, 21 calendar days immediately following either the day of delivery of the policy or cooling-off notice (informing you / your nominated representative about the availability of the policy and expiry date of the cooling-off period, whichever is earlier)). After the expiration of the cooling-off period, if you cancel the policy before the end of the term, the projected total cash value may be substantially less than the total premium you have paid.

Important Notes from the Insurance Agent of The Bank of East Asia, Limited

- The Bank of East Asia, Limited (“BEA”), being registered with the Insurance Authority as a licensed insurance agency, act as an appointed licensed insurance agent for AIA International Limited (incorporated in Bermuda with limited liability) (“AIA”). This insurance plan is a product of AIA but not BEA.

- This insurance plan is underwritten by AIA and it is not a bank savings plan with free life insurance coverage. Part of the premium pays for the insurance and related costs. The premium paid is not a placement of a savings deposit with the bank and hence is not protected by the Deposit Protection Scheme in Hong Kong.

- Add-on plan (if any) is an add-on coverage for this insurance plan with additional premium paid required. BEA does not distribute any add-on plan; therefore, you cannot apply the add-on plan through BEA. If needed, you can contact AIA Customer Service Centre for inquiry after the policy is issued by AIA.

- In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between BEA and the customer out of the selling process or processing of the related transaction, BEA is required to enter into a Financial Dispute Resolution Scheme process with the customer; however, any dispute over the contractual terms of the product should be resolved between AIA and the customer directly.

- Claims under this insurance plan must be made by you to AIA directly. You can get the appropriate claim form by calling AIA Customer Service Hotline (852) 2232 8968 in Hong Kong or visiting www.aia.com.hk or any AIA Customer Service Centre. For details, please refer to the policy contract provided by AIA.

- BEA’s sales staff (including direct sales staff and authorised agents) are remunerated not only based on their financial performance, but also according to a range of other factors, including their adherence to best practices and their dedication to serving customers’ interests.

- The information you disclosed in response to all AIA’s questions must be true, complete and correct. Failure to disclose true, complete and correct information to AIA may render AIA unable to accept or process your application or the policy void.

- You are reminded to carefully review the relevant product materials provided to you and be advised to seek professional/ independent advice when considered necessary.

- For the benefits and returns mentioned throughout the product brochure and Important Notes, please note that the policy owner is subject to the credit risk of AIA. If the policy owner discontinues and/or surrenders this policy in early policy years, the amount of benefits he/she will get back may be considerably less than the total premiums he/she has paid. Projected and/or potential benefits and/or returns (e.g. reversionary bonus, terminal bonus) presented in the product brochure are not guaranteed and are for illustrative purposes only. The actual future amounts of benefits and/or returns may be lower than or higher than the currently quoted benefits and/or returns.

-

Apart from the key product risks mentioned in product brochure, you are also reminded of the following risks:

- Liquidity risk – this insurance plan is designed to be held long term. You should only apply for this insurance plan if it is intended to pay the premium for the whole of the premium payment term. If you fail to pay the premium for the whole of the premium payment term, this will cause the policy to lapse or to be terminated earlier than the original benefit term, and the total surrender value (if any) that get back by you may be less than the total premiums paid.

- Risk from surrender – if you cancel the policy before the end of the benefit term, you may suffer a significant loss, and the total surrender value received may be substantially less than the total premiums paid.

- Non-guaranteed bonus scales – non-guaranteed benefits are based on the bonus scales of AIA determined under current assumed investment return. The actual amount payable may change anytime with the values being higher or lower than those being projected. In other words, a change in the current assumed investment return will affect the reversionary bonus and terminal bonus you will receive. Under some circumstances, the non-guaranteed benefits may be zero.

- Risk relating to RMB insurance products – The value of RMB is subject to the fluctuation of its exchange rate. There may be exchange rate loss suffered by you due to such fluctuation if you convert RMB into other currencies (including Hong Kong Dollars).

[For personal customer] – RMB is currently not completely freely convertible. Personal customers can be offered to conduct conversion of RMB by the bank using offshore rates and may occasionally not be able to do so fully or immediately as it is subject to the RMB position and market conditions at that time.

[For corporate customer] – RMB is currently not completely freely convertible. Corporate customers can be offered to conduct conversion of RMB by the bank using offshore rates or onshore rates depending on the objective of conversion and may occasionally not be able to conduct fully or immediately as it is subject to the RMB position and market conditions at that time.

You should understand and consider the possible impact on the liquidity of RMB funds. The exchange rate for the offshore RMB market in Hong Kong may be at a premium or discount when compared to the onshore market in People’s Republic of China and there may be significant bid and offer spreads.