1.1.1 What is a unit trust?

A unit trust refers to a collective investment scheme pooling money from individual investors, with a large portfolio of securities (e.g. equities, bonds, currency, and other financial instruments) managed according to pre-set investment objectives by professional fund managers.

1.1.2 What are the categories of unit trusts?

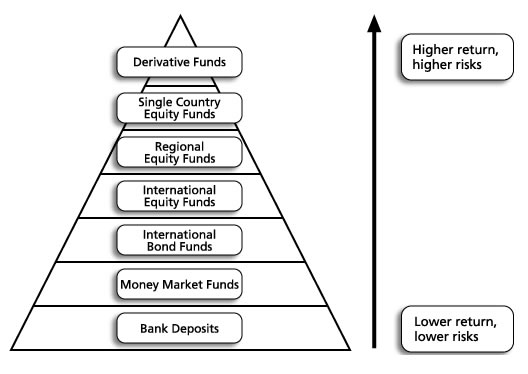

Unit trusts can be divided into the following categories:

-

- Asset allocation

- Equity

- Fixed income / Bonds

- Money market

- Warrants or Derivatives

- Others

1.1.3 What are the advantages of investing in unit trusts?

Some of the key advantages are as follows:

-

- Low minimum investment with many choices:

With a minimum investment amount, an investor can invest in a wide array of securities through funds. For instance, an equity fund usually holds at least 40-50 stocks, and for some unit trusts, which have larger asset sizes, they may hold over a hundred stocks.

-

- Access to global investment opportunities:

Through unit trusts, the investment horizon can be broadened because there are different types of funds which can provide you with a very convenient and cost-effective way to capitalise on both local and overseas investment opportunities. With unit trusts, an investor can avoid being bogged down in a particular market or by a particular type of instrument.

-

- Diversification:

Diversification may take different forms, e.g. along geographic or industry lines, or among different securities or issuers. The essence is that by investing in securities that have a low correlation, a portfolio can help an investor spread out risks and achieve a better risk-return behaviour than individual securities. The Code on Unit Trusts and Mutual Funds issued by the Securities and Futures Commission ("SFC") has detailed requirements to ensure sufficient spread of investments

-

- Access to professional investment management services:

With unit trusts, an investor can enjoy the services rendered by fund managers. Fund managers help research and analyse the markets and securities for the funds. Fund managers determine which securities an investor should hold, and when to buy or sell. They make decisions based on extensive research into the performance of individual stocks or other security issues, as well as the fundamentals of the economies and market trends.

With unit trusts, investors are relieved of these often onerous and time-consuming tasks of studying and picking specific securities.

-

- Convenience:

If investing in individual stocks directly, an investor has to handle custody and administration for each and every single stock. However, with funds, the investor enjoys "one-stop" service, as he / she can invest in a range of stocks, but can dispense with the tedious task of arranging payment, settlement, and other related administration work for each individual stock. Also, it is relatively easy to buy funds. Investors can buy them through banks, independent financial advisors, or direct from fund houses.

1.1.4 What is fund switching?

Switching means that the investor moves out from a sub-fund to another sub-fund, within the same umbrella fund.

An umbrella fund comprises a number of sub-funds. Each sub-fund is an independent unit trust and is separately managed with its own investment objectives. An umbrella fund offers investors a wide range of investment opportunities, together with a simple method of switching from one sub-fund to another.

Usually, if an investor invests in a fund, say Z, he / she has to pay the subscription fee in full. However, if the investor switches from X to Z, he / she will very often not be charged the full subscription fee for Z, but only at a discounted rate.

Sometimes, an investor may also be entitled to a discounted rate, if switching from a single fund (not a sub-fund) to another single fund within the same fund group. As to what switching discounts an investor will be entitled to, this will depend on the value of his / her investment. The investor have to check with the fund houses.

1.1.5 Can investors redeem unit trusts at any time?

Investors may redeem unit trusts within trading hours on any business day. Details of which are stated in the respective prospectus of the unit trust.

1.1.6 What are the differences and pros & cons between lump sum and monthly investments?

A lump sum investment refers to the investment of a lump sum of money as a one-off investment into a specific fund or selected funds. A monthly investment means making regular contributions to the fund. Through monthly investment, the dollar-cost averaging effect takes place and reduces the volatility throughout the investment period. For monthly investments, investors need not to worry about the short-term ups and downs. Such investment also helps to reduce the average share cost to an investor in the long-term; when the unit price rises, he / she will buy fewer units; when the unit prices falls, he / she will buy more.