Currency Linked Deposit

Earn potential attractive returns from foreign exchange investments*

with BEA currency linked deposits

|

Key Features and Risks Disclosure: Currency Linked Deposits (“CLDs”) are unlisted structured investment products involving derivatives. The investment decision is yours but you should not invest in this product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives. |

- What are the key features?

- Illustrative Example

- Best Case Scenario

- Loss Scenario

- Worst Case Scenario

- Default Scenario

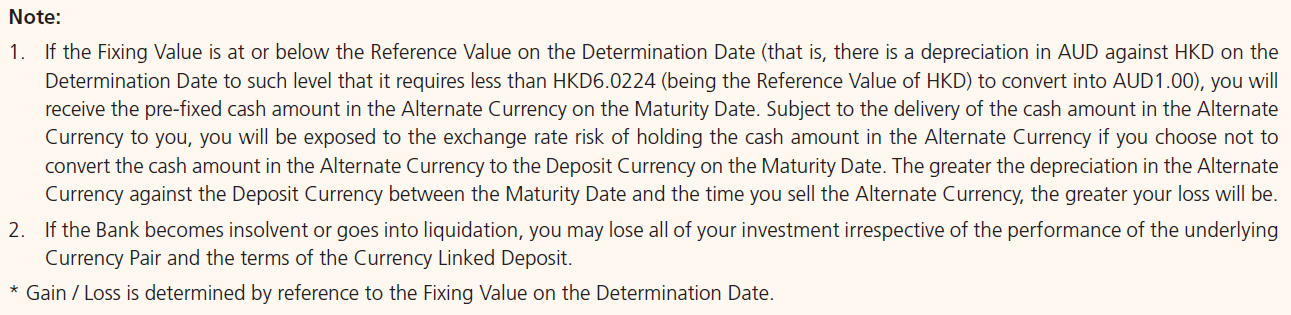

- Scenario Analysis

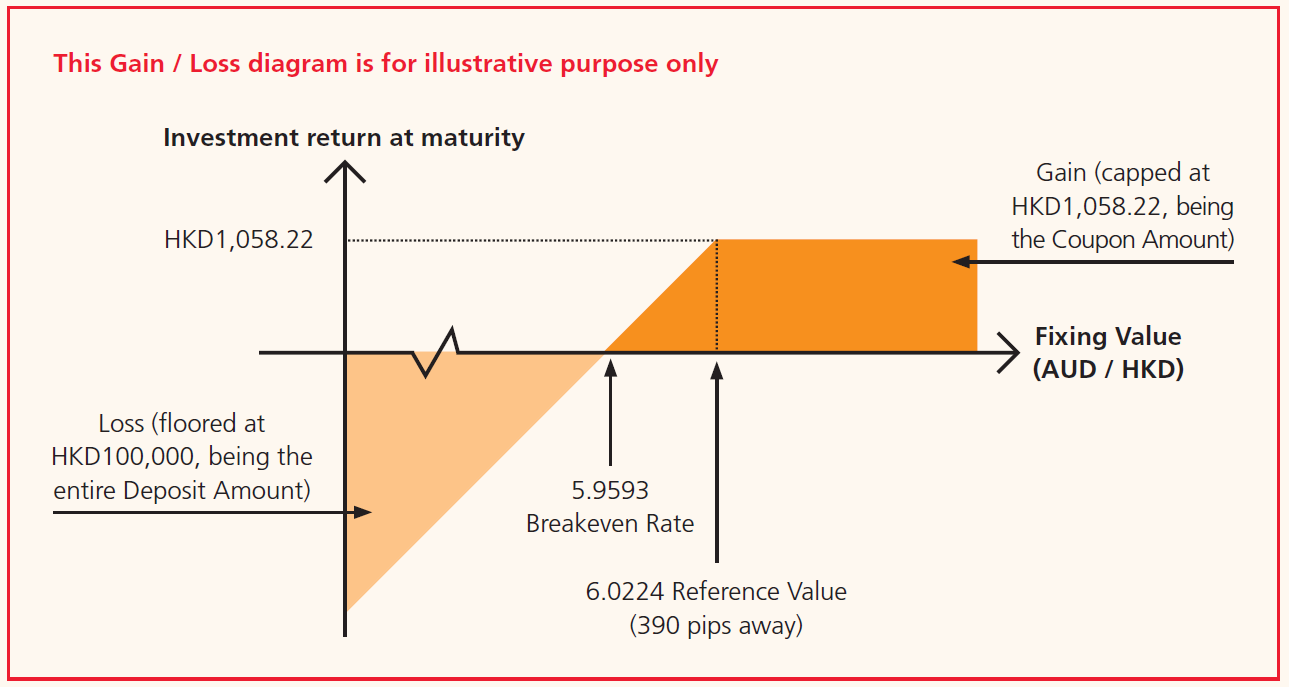

- Gain/Loss Diagram

- Principal Brochure

* Subject to investment risk

Note: Principal Brochure is available in English and Traditional Chinese versions only.

(The Acrobat plug-in is required to view the above content)

Other Features and Risks Disclosure :

- CLDs are not the same nor should it be treated as a substitute for conventional time deposits. CLDs are not protected deposits under the Deposit Protection Scheme or covered by the Investor Compensation Fund in Hong Kong. CLDs are NOT principal-protected and you could lose all of your Deposit Amount in the worst case scenario. CLDs are designed to be held to maturity. You are not allowed to early terminate the CLDs. There is no secondary market for CLDs. Investment involves risks. The exchange rate of currencies fluctuates, sometimes dramatically. Losses may be incurred rather than profit made as a result of investing in CLDs. Investing in CLDs is not the same as buying either of the Currency Pair directly. If there is a depreciation in the Alternate Currency relative to the Deposit Currency to or beyond the Reference Value, you will receive your payoff at maturity in the Alternate Currency. BEA has the right to early terminate the CLDs upon the occurrence of certain events. CLDs are not secured by any collateral. The payout of the product is subject to BEA’s creditworthiness, you may lose your entire investment. If the CLDs involve Renminbi, you should note that Renminbi is currently not freely convertible. The value of Renminbi against other currencies fluctuates and will be affected by the control of the central government of the People’s Republic of China. Please note that the risk factors mentioned are not, and do not purport to be, exhaustive. You should not make an investment decision based solely on this material. Before making any investment decision, you should refer to all relevant offering documents for detailed information including the risk factors.

- BEA is listed on The Stock Exchange of Hong Kong Limited and is regulated by the Hong Kong Monetary Authority. You may access BEA's latest annual report and any interim results by visiting www.hkbea.com.

Disclaimer:

- The information provided in this message is intended solely for informational purposes and does not constitute an offer, solicitation, invitation, or advice to purchase or subscribe to CLDs or any investment products.

- The information provided in this message is subject to change without notice. BEA makes no guarantee, representation or warranty as to the accuracy, adequacy or completeness of the contents of this message and under no circumstances will BEA be liable for any losses, costs or damages caused by the use of or reliance on the contents of this message.

TOP

What are the key features?

TOP

Illustrative Example

The following hypothetical examples are for illustrative purposes only. They do not reflect a complete analysis of all possible gain or loss scenarios and must not be relied on as an indication of the actual performance of the Currency Pair or the CLD.

Example: On 7th July 20xx, AUD/HKD is trading at 6.0614 (i.e. HKD6.0614 is required to convert into AUD1.00).

Each hypothetical example below is based on the following terms:

|

Currency Pair |

: |

AUD/HKD |

|

Deposit Currency |

: |

HKD |

|

Deposit Amount |

: |

HKD100,000.00 |

|

Alternate Currency |

: |

AUD |

|

Fixing Value |

: |

The exchange rate of the Currency Pair at 2 p.m. Hong Kong time on the Determination Date, as determined by the Bank in its sole and absolute discretion by reference to the international foreign exchange market or such other price sources that the Bank reasonably considers appropriate taking into account the then conventional market practice. |

|

Reference Value |

: |

6.0224 |

|

Trade Date |

: |

7th July 20xx |

|

Settlement Date |

: |

8th July 20xx |

|

Determination Date |

: |

6th August 20xx |

|

Maturity Date |

: |

7th August 20xx |

|

Deposit Tenor |

: |

30 days |

|

: |

12.875% per annum |

|

|

Coupon Amount

|

: |

Deposit Amount x Coupon Rate x Deposit Tenor / Coupon Date Count Basis |

TOP

Best case scenario

Best case scenario - Fixing Value > Reference Value (where there is no depreciation in AUD against HKD beyond the Reference Value on the Determination Date)

If the Fixing Value is 6.0400, which is above the Reference Value (6.0224) (that is, there is no depreciation in the prevailing market value of AUD relative to HKD beyond the Reference Value), you will receive the Deposit Amount together with the Coupon Amount in HKD on the Maturity Date, equal to HKD101,058.22.

Calculation Method:

= Deposit Amount + Coupon Amount

= HKD100,000.00+ HKD1,058.22

= HKD101,058.22

In this scenario, you make a gain of HKD1,058.22 (representing 1.06% of your Deposit Amount).

TOP

Loss scenario

Loss scenario - Fixing Value < Reference Value (where there is a slight depreciation of AUD against HKD beyond the Reference Value on the Determination Date)

If the Fixing Value is 5.6000, which is below the Reference Value (6.0224) (that is, there is a slight depreciation in the prevailing market value of AUD relative to HKD beyond the Reference Value), you will receive a pre-fixed amount on the Maturity Date equal to the sum of the Deposit Amount and the Coupon Amount converted into AUD at the Reference Value, being AUD16,780.39.

Calculation Method for the pre-fixed amount in AUD:

= AUD [(Deposit Amount + Coupon Amount) / Reference Value]

= AUD [(HKD100,000.00+ HKD1,058.22) / 6.0224]

= AUD16,780.39

If you are able to immediately convert the pre-fixed AUD amount into HKD at the prevailing exchange rate of 5.6000, the value of the cash amount you receive on the Maturity Date will be:

= HKD(AUD 16,780.39 x 5.6000)

= HKD93,970.18

In this scenario, you will suffer a loss of HKD6,029.82 (representing 6.03% of your Deposit Amount).

TOP

Worst case scenario

Worst case scenario - Fixing Value = 0 (where there is a substantial depreciation of AUD against HKD beyond the Reference Value on the Determination Date)

If the Fixing Value is 0, which is below the Reference Value (6.0224) (that is, there is a substantial depreciation in the prevailing market value of AUD relative to HKD), you will receive a pre-fixed amount on the Maturity Date equal to the sum of the Deposit Amount and the Coupon Amount converted into AUD at the Reference Value, being AUD16,780.39.

Calculation Method for the pre-fixed amount in AUD:

= AUD [(Deposit Amount + Coupon Amount) / Reference Value]

= AUD [(HKD100,000.00 + HKD1,058.22) / 6.0224]

= AUD16,780.39

If you are able to immediately convert the pre-fixed AUD amount into HKD at the prevailing exchange rate of 0, the value of the cash amount you receive on the Maturity Date will be:

= HKD(AUD 16,780.39 x 0)

= HKD0

In this scenario, you will suffer a loss of HKD100,000.00 (representing 100% of your Deposit Amount).

TOP

Default scenario

Default scenario - The Bank becomes insolvent or defaults on its obligations

Assuming that the Bank becomes insolvent during the Deposit Tenor or defaults on its obligations under the Currency Linked Deposit, you can only claim as unsecured creditor of the Bank regardless of the performance of the Currency Pair. You may get nothing back and suffer a loss of 100% of your Deposit Amount.

Coupon Amount: HKD0

Deposit Amount: HKD0 (loss of 100% of your Deposit Amount)

TOP

Scenario Analysis

TOP

Gain/Loss Diagram

TOP