Basic Knowledge

What is a unit trust?

A unit trust refers to a collective investment scheme pooling money from individual investors, with a large portfolio of securities (e.g. equities, bonds, currency, and other financial instruments) managed according to pre-set investment objectives by professional fund managers.

What are the categories of unit trusts?

Unit trusts can be divided into the following categories:

- Asset allocation

- Equity

- Fixed income / Bonds

- Money market

- Warrants or Derivatives

- Others

What are the advantages of investing in unit trusts?

Some of the key advantages are as follows:

- Low minimum investment with many choices:

With a minimum investment amount, an investor can invest in a wide array of securities through funds. For instance, an equity fund usually holds at least 40-50 stocks, and for some unit trusts, which have larger asset sizes, they may hold over a hundred stocks. - Access to global investment opportunities:

Through unit trusts, the investment horizon can be broadened because there are different types of funds which can provide you with a very convenient and cost-effective way to capitalise on both local and overseas investment opportunities. With unit trusts, an investor can avoid being bogged down in a particular market or by a particular type of instrument. - Diversification:

Diversification may take different forms, e.g. along geographic or industry lines, or among different securities or issuers. The essence is that by investing in securities that have a low correlation, a portfolio can help an investor spread out risks and achieve a better risk-return behaviour than individual securities. The Code on Unit Trusts and Mutual Funds issued by the Securities and Futures Commission ("SFC") has detailed requirements to ensure sufficient spread of investments. - Access to professional investment management services:

With unit trusts, an investor can enjoy the services rendered by fund managers. Fund managers help research and analyse the markets and securities for the funds. Fund managers determine which securities an investor should hold, and when to buy or sell. They make decisions based on extensive research into the performance of individual stocks or other security issues, as well as the fundamentals of the economies and market trends.

With unit trusts, investors are relieved of these often onerous and time-consuming tasks of studying and picking specific securities. - Convenience:

If investing in individual stocks directly, an investor has to handle custody and administration for each and every single stock. However, with funds, the investor enjoys "one-stop" service, as he / she can invest in a range of stocks, but can dispense with the tedious task of arranging payment, settlement, and other related administration work for each individual stock. Also, it is relatively easy to buy funds. Investors can buy them through banks, independent financial advisors, or direct from fund houses.

- Low minimum investment with many choices:

What is fund switching?

Switching means that the investor moves out from a sub-fund to another sub-fund, within the same umbrella fund.

An umbrella fund comprises a number of sub-funds. Each sub-fund is an independent unit trust and is separately managed with its own investment objectives. An umbrella fund offers investors a wide range of investment opportunities, together with a simple method of switching from one sub-fund to another.

Usually, if an investor invests in a fund, say Z, he / she has to pay the subscription fee in full. However, if the investor switches from X to Z, he / she will very often not be charged the full subscription fee for Z, but only at a discounted rate.

Sometimes, an investor may also be entitled to a discounted rate, if switching from a single fund (not a sub-fund) to another single fund within the same fund group. As to what switching discounts an investor will be entitled to, this will depend on the value of his / her investment. The investor have to check with the fund houses.

Can investors redeem unit trusts at any time?

Investors may redeem unit trusts within trading hours on any business day. Details of which are stated in the respective prospectus of the unit trust.

What are the differences and pros & cons between lump sum and monthly investments?

A lump sum investment refers to the investment of a lump sum of money as a one-off investment into a specific fund or selected funds. A monthly investment means making regular contributions to the fund. Through monthly investment, the dollar-cost averaging effect takes place and reduces the volatility throughout the investment period.

For monthly investments, investors need not to worry about the short-term ups and downs. Such investment also helps to reduce the average share cost to an investor in the long-term; when the unit price rises, he / she will buy fewer units; when the unit prices falls, he / she will buy more.

Guaranteed Funds

What is a guaranteed fund?

A guaranteed fund is a type of collective investment scheme that guarantees to pay you back a predetermined amount on a specific date. The guaranteed amount may include a percentage of capital, plus, in some cases, an additional return. Some guaranteed funds also provide an additional incentive by distributing parts of the guaranteed return at certain predefined dates before maturity.

How is a guarantee made possible?

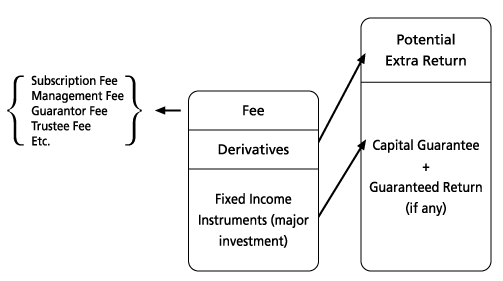

There are many ways to provide guaranteed returns to guaranteed fund holders. The following is an example to illustrate the capital guaranteed fund structure:

The fund's money is divided into two parts. After deduction of required fees, a major part of the fund's money is invested in fixed income instruments (e.g. zero-coupon bonds) with maturity dates similar to those of the fund. On maturity, the principal and interest earned from this part of the investment enable fund holders to receive a capital guarantee and, for some capital guaranteed funds, a guaranteed return.

The remainder of the investment capital is invested according to the fund's investment objectives in derivatives like options and warrants. This allows the fund to potentially gain extra return. The return from this part of the investment is calculated by multiplying the participation rate by the performance of certain specified underlying instruments or pre-determined index when the fund matures.

What to consider before investing in a guaranteed fund?

- The guarantee only applies if the investor holds the investment until maturity

Every guaranteed fund has a maturity date. To enjoy the guarantee, investors have to stay in a guaranteed fund until its maturity. Units redeemed before the maturity date will not be protected by the guarantee. In addition, if an investor redeems before maturity, he / she will have to sell the units at the prevailing market price. This may be lower than the price at which a particular fund was bought, which means a loss for the investor. - Fees and charges made upfront

Many guaranteed funds do not have an initial charge. But the charges such as the management fee, trustee fee, establishment costs, and guarantor fee are generally charged once invested in the fund. If the investor redeems units before the maturity date, he / she is unlikely to get a rebate for those fees. Thus, the investor may suffer a loss on original investment if he / she doesn't hold the units to maturity. - Early redemption charge

Some fund houses may try to discourage fund holders from redeeming units before maturity by levying an "early redemption charge". The charging scheme is usually calculated on a sliding scale that depends on the holding period. - Guarantor's credit risk

All investments carry risks, and a guaranteed fund is no exception. In normal situations, the guarantor has to pay to investors if the fund doesn't generate enough income to repay the guaranteed amount. However, guarantors that run into financial problems may be unable to fulfil their obligations. As a result, the investor may suffer a severe loss. - Performance dilution

The upside potential of a guaranteed fund is limited as the major part of the investment is put into fixed income instruments to support the guarantee. - Potential return calculation

In fact, the returns of some unit trusts are linked to the worst performing stocks in the stock basket. The returns of other funds are capped during specific periods, so investors will not benefit from further performance in the underlying investments. Some unit trusts also have "trigger events" (these are defined in the offering document) that may affect an investor's return. For instance, the greater the number of stocks in the stock basket that drop below a certain threshold, the lower your return.

- The guarantee only applies if the investor holds the investment until maturity

Fees and Prices

What kind of fees does an investor need to pay?

In general, investors may need to pay two types of fee for unit trust investments:

- Initial subscription charge or front-end fee / realisation charge or back-end fee

- Annual management fee

There may be more specific fees and charges, such as custodian fees, performance fees, etc., depending on the requirements listed on the respective fund's explanatory documents or prospectus.

What is the meaning of Net Asset Value?

Net Asset Value or "NAV" is derived by subtracting the liabilities of a fund from its total assets, and then dividing it by the number of shares outstanding. Valuation of a fund is usually calculated daily and the NAV will fluctuate in line with the securities that the fund holds.

Can fees be raised as much as fund manager likes and without prior notice?

The offering document list charges for subscribing, redeeming, and switching between funds. Normally, it also indicates the current and maximum levels of fees and charges payable by the fund such as management fees, trustee fees, and start-up expenses.

The offering document also states the notice period required for any fee increases. If the new fee is within the maximum stated in the constitutive document, generally three months prior notice must be given to the fund holders, otherwise, shareholders' prior approval may be required.

Unit Trusts Management

What is a fund manager?

A fund must have a fund manager, trustee, and / or a custodian acceptable to the SFC before it can be authorised.

A fund manager must:

- be engaged primarily in the fund management business;

- have sufficient financial resources, proper internal control, and written compliance procedures;

- ensure that the company's director and key personnel have sufficient experience in managing the same kind of fund.

How are fund managers supervised?

Depending on its business nature, a fund manager based in Hong Kong may be required to be licenced by the SFC. A licenced fund manager should comply with relevant securities ordinances and rules, and the Fund Manager Code of Conduct. This provides guidance on organisational structure, staff ethics, fund management, operations, and client dealings. Agreements between foreign authorities and the SFC assure timely exchange of information related to the overseas domiciled fund managers who manage authorised unit trusts. Overseas fund managers without branch offices in Hong Kong must appoint Hong Kong representatives to liaise with Hong Kong investors and the SFC. Representatives who also manage the unit trusts' subscription and redemption activities must register with the SFC as dealers.

To ensure compliance, the SFC will conduct inspection of locally-based fund managers on a rotation basis. Apart from routine checks, the SFC may also carry out "special" or "theme" inspections.

On a day-to-day basis, the fund's trustees / custodians are responsible for monitoring the operation of the fund managers and the fund. The role of the trustees is to ensure that fund managers comply with the unit trust constitutive offering documents and that the interests of the beneficiaries, i.e. investors, are best protected.

How does an investor know if fund managers put his / her interests before their own?

The Fund Manager Code of Conduct states that fund managers should always put investors' interests before their own. They should execute orders on behalf of funds on the best available terms in the market and give priority to those orders over those on house accounts owned by the fund managers themselves. Failure to follow the Code of Conduct impugns a fund manager's Hong Kong registration.

Offering Documents

What will an offering document tell an investor?

A fund's offering document, often referred to as an explanatory memorandum or a prospectus, lists the investment objectives and restrictions, its characteristics, risk disclosure, fees, dealing procedures, conditions leading to deferral, suspension, or even termination of the fund, as well as sources of further information. It should be available in both English and Chinese. An application form for subscription can only be distributed together with an offering document.

Why should an investor read financial reports?

Audited annual reports and semi-annual reports keep investors informed about the fund's income and expenses and investment portfolio at the mid-point and end of the financial year. They highlight dividend distribution, unit issuance / redemption activity and a performance history including its net asset value for the past three financial years.

An important point to note is that past performance is not indicative of future performance. Therefore, such reports should only be used as reference in any investment decision.

The majority of the above information is sourced from the InvestEd website operated by the Securities and Futures Commission, and Hong Kong Investment Funds Association.