What are the risks and returns when investing in unit trusts?

As there is a trade-off between risks and returns, investors should weigh both factors carefully before entering an investment transaction.

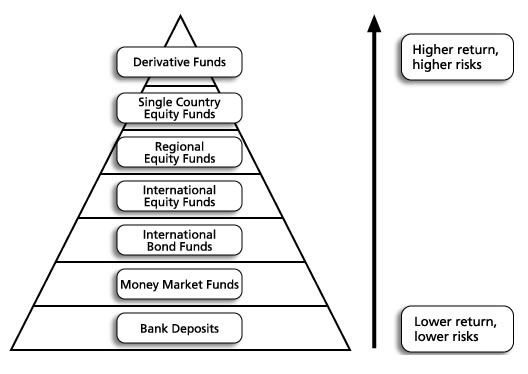

Risks and returns vary with the types of unit trusts. Generally speaking, higher risks go with higher returns and vice versa. Risk appetites vary with an investor's age, income and financial position, as well as his / her investment objectives and risk tolerance level. The followings are some of the risks of specific fund types that investors should take into account:

- Equity funds:

- Risks of underlying equities:

Unsystematic risks: company-specific (e.g. a competitor introduces an innovative product, which boosts its market share substantially)

Systematic risks: applicable to the overall market (e.g. stock market crash of 1987) - Risks on foreign currency fluctuations

- Risks of underlying equities:

- Bond funds:

- Interest rate risk: when interest rates go down, bond prices usually go up and vice versa.

- Default risk: the possibility of an issuer failing to pay interests or repay the principal.

- Inflation risk: Despite more stable returns than equity funds, the total returns may fail to keep pace with inflation rate.

- Prepayment risk: This may happen when interest rates fall and issuer may prepay before the bond matures.

- Money market funds:.

- Since the money market fund is relatively stable in character, it would be risky if it fails to beat inflation in the long-run. In other words, the money may be worth less and less.

- Equity funds:

How do investors select unit trusts?

Investors are advised to follow the following three steps before making an investment decision involving unit trusts.

- Step 1 - Self-assessment of personal financial background

- Monthly income and expenditure

- Total assets, including properties, stocks, etc.

- Family obligations, for example, funding of children's education

- Other financial obligations, such as mortgages, pensions, and insurance premium payments.

- Step 2 - Select the appropriate fund sector

- Self-assessment on investment objectives:

Different investment objectives lead to different investment approaches, e.g. if the objective is to maximise capital growth, then a higher proportion of equities should be allocated to investment portfolios. - Self-assessment on risk / return expectations:

Investors should ask themselves whether they can tolerate higher risks while receiving higher potential returns. If they intend to invest in instruments with higher potential returns, they should be prepared to accept greater short-term price volatility. - Self-assessment on investment time frame:

Investors should ask themselves how long they can put aside money for investment. If they intend to use the money in the next few days, weeks, or even months, liquidity will be a key consideration, and investors should consider placing their money in deposits.

- Self-assessment on investment objectives:

- Step 3 - Fund selection

Once investors have identified the types of fund to invest in, they should try to obtain more information on unit trusts within these sectors, and read the explanatory memoranda and financial reports. In addition, investors should check the authorisation status of the fund with the SFC. Investors should be aware of the following issues when selecting unit trusts:- Does the fund's investment objectives match with investor's own objective?

- Comparison of the fund's performance and volatility against:

the peers (say via the sector median), and

the relevant benchmark. - Investment details, including fees and charges, subscription, redemption, switching, and other dealing procedures.

- Step 1 - Self-assessment of personal financial background

How should investors compare the performances of unit trusts?

Usually, investors can use three factors to evaluate fund performance:

Usually, investors can use three factors to evaluate fund performance:

- Peer groups: Investors can compare a fund's performance against funds that have similar investment objectives and invest in the same asset class. In making the comparison, investors can look at the sector median, which should give them an idea of the overall performance of the unit trusts within the sector.

- Benchmarks: Benchmarks refer to well-established and commonly used indices that are representative of the markets in which the securities invest. To a certain extent, a benchmark can give an investor an indication of the value-added brought by the fund managers. Investors are advised to look at the peer group performance as well as the benchmarks because there may be some unit trusts that appear to perform relatively poor against the relevant benchmark, but actually outperform their peers.

- Time frame: Investors should also look at how different unit trusts perform over different time frames (e.g. one year, three years, etc.) so as to have a better understanding of how the funds have performed in different investment environments.

Note: Past performance is not indicative of future returns and customers should not just focus on performance, but also consider other factors in selecting a fund.

How can investors make money from unit trusts investment?

Investors can make money in two ways:

- Dividend / income growth: this refers to the income paid out from the fund, which can be on a regular or irregular basis.

- Capital growth: if bonds, stocks, or other securities held by a fund increase in value, the value of portfolio shall increase and vice versa.

The majority of the above information is sourced from the InvestEd website operated by the Securities and Futures Commission, and Hong Kong Investment Funds Association.