With a BEA corporate account, you can manage your finances and assets more effectively than ever through multiple banking channels. An integrated and flexible solution has been specially tailored to suit the needs of corporate customers and enhance the efficiency of your business.

|

CorporatePlus Account is an all-in-one account which allows you to manage a full range of banking products. Savings, current, time deposit, and investment sub-accounts are consolidated under a single account number, so you can manage your company’s finances effectively. A CorporatePlus Account is suitable for sole proprietorships, partnerships, firms, companies, trustees (whether corporate or individual), statutory bodies, government institutions, charitable organisations, societies, clubs, associations, and other entities.

You can apply to open an account through any of the following channels:

Click here to complete an online application* and upload supporting documents. Our service representative will contact you about account opening arrangements.

|

Step 1 Provide basic details about |

Step 2 Submit supporting |

Step 3 We will contact you to understand your company operations and arrange appointment, then visit BEA to complete identity verification and sign application form to proceed account opening. |

| *Online application is only applicable for company which can meet below criteria to apply: | |

| • | Sole proprietorship, partnership or limited company incorporated in Hong Kong; and |

| • | Without any corporate directors, shareholders and/or authorized signatories; and |

| • | Up to 3 individual directors / shareholders / authorised signatories |

| Company is required to provide all necessary documents and information for processing and visit BEA to sign and complete application. | |

Call now to reserve an appointment. Service hours are from 9 a.m. to 5 p.m., Monday – Friday (excluding public holidays).

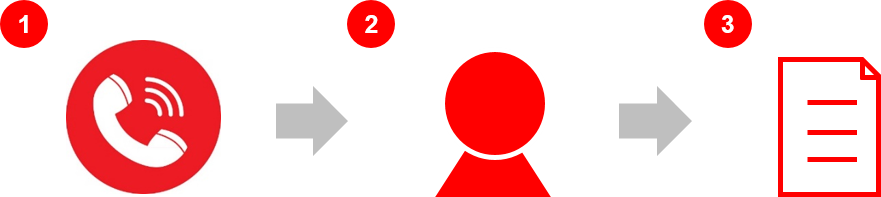

| Press 3 > 7 to talk to one of our service representatives. | Our service representative will advise you on professional solutions and start the account opening process. | Submit documents for our preliminary review. |

| We will contact you within the next 2 working days (excluding Saturday). | Please attend an appointment in one of our Business Centres to sign the necessary documents. | Designated account manager to keep track of your account opening status. |

You are welcome to visit any of our Business Centres to learn more about the account opening procedure:

| Business Centre | Address |

|---|---|

| Main Branch Business Centre | 14/F, 10 Des Voeux Road Central, Central |

| Mongkok Business Centre | 2/F, 638-640 Nathan Road, Mongkok |

| Cheung Sha Wan Plaza Business Centre | Shop 125A & 125BC, 1/F, Cheung Sha Wan Plaza, 833 Cheung Sha Wan Road, Cheung Sha Wan |

| Sheung Shui Landmark North Business Centre | Office No. 916-918, Level 9, Landmark North, 39 Lung Sum Avenue, Sheung Shui |

Click here to learn about our Business Centre network.

Preferential Interest RateGet a preferential interest rate by placing an HKD/USD/RMB time deposit with new funds. Please visit any BEA branch for details. Quota and terms & conditions apply.

Free Membership in Employee Benefit SchemeCorporatePlus Account customers are entitled to free membership in the Employee Benefit Scheme, allowing employees to enjoy fabulous privileges along with our banking and financial services, including auto-payroll, credit cards, general insurance, and loans.

Financial Privileges1Investment and selected general insurance plans:

Banking services:

Service fee waivers:

|

You can manage all of your company’s finances through a single account:

Manage corporate expenses and maximise your working capital. For details, please click here.

| - | Internet |

| - | Mobile |

| - | Phone |

| - | ATM |

| - | Set up pre-defined instructions (zero balancing or balance sweeping) for fund transfers to pre-designated accounts of BEA, other local banks, or overseas banks according to a defined schedule |

| - | Make real-time or scheduled payments to more than 800 merchants |

| - | Approve e-bills enrolment, and present e-bills or e-payment receipts to customers |

| - | View cheque status and images |

| - | Download merchant and account transactions |

| - | Issue and deposit e-cheques |

Centralise control over payroll and MPF contributions:

Your CorporatePlus Account Card4 enables you to manage up to three of your HKD accounts through JETCO ATMs in Hong Kong, Mainland China, and Macau. Functions including cash withdrawal, deposits5, fund transfers and bills settlement through JETCO payment. Through the UnionPay network, you can withdraw cash instantly from ATMs worldwide.

Deposit Card4 enables you to deposit cash or cheques through BEA ATMs6 with much faster processing. Product highlights:

Tailor an investment strategy to suit your company’s needs3, with an extensive range of investment products and expert analysis from a Relationship Manager:

Open an account by making an initial deposit of HK$10,000 (or its equivalent). Please visit your nearest BEA branch for details.

We also offer a "CorporatePlus - Business Start Account" ("Business Start Account") for companies at earlier stage of growth:

Business Start Account is a simplified version of the CorporatePlus Account, with fewer account opening document requirements. For example, business proof is not required in the account opening process. New Hong Kong-incorporated start-up businesses such as sole proprietorships, partnerships, and limited companies which have been established for less than 1 year and with operations in Hong Kong are welcome to apply. The Account’s daily deposit balance is capped at HK$500,000 (or equivalent in other currencies) and the total amount of debit transactions and cash withdrawals through all banking channels is capped at HK$500,000 (or equivalent in other currencies) per calendar month. For other account features and further details, please refer to the Fact Sheet and Terms and Conditions for CorporatePlus – Business Start Account3.

Please call BEA Corporate Express (2211 1868) for enquiries or to book an appointment to open an account at a designated Business Centre.

Remarks:

| 1 | Terms and conditions apply. For details, please refer to relevant promotional material or contact BEA staff. |

| 2 | Applies to payments made through MAS Services. |

| 3 | Investment and trade finance services are not available with a Business Start Account. Business Start Account customers may apply to upgrade to a CorporatePlus Account in order to enjoy the full services of a standard account. For details, please refer to the Fact Sheet and Terms and Conditions for the CorporatePlus – Business Start Account. |

| 4 | The CorporatePlus Account Card and/or Deposit Card is provided upon request. |

| 5 | Available at BEA ATMs in Hong Kong only. |

| 6 | Available at ATMs with cash deposit and/or cheque deposit functions only. |

Important notes

| • | Investment involves risk. Before making an investment decision, investors should refer to the relevant investment product offering documents for detailed information including the risk factors. Investors should not make an investment decision based solely on this page. If investors are in doubt, independent professional advice should be sought. |

| • | Linked deposits are structured products involving derivatives. Linked Deposit is not equivalent to a time deposit and is not a protected deposit under the Deposit Protection Scheme in Hong Kong. The investment decision is yours, but you should not invest in linked deposits unless the intermediary who sells them to you has explained to you that the linked deposits are suitable for you having regard to your financial situation, investment experience, and investment objectives. |

| • | The prices of securities fluctuate, sometimes dramatically. The prices of securities may move up or down, and may become valueless. Losses may be incurred rather than profit made as a result of buying and selling securities. |

| • | The information provided in this page is intended solely for informational purposes and does not constitute an offer, solicitation, invitation, or advice to subscribe to any securities or investment products. |

| • | The selected general insurance plans are underwritten by Blue Cross (Asia-Pacific) Insurance Limited (“Blue Cross”), a subsidiary of AIA Group Limited. The Bank of East Asia, Limited (“BEA”) is an appointed insurance agency of Blue Cross. The insurance plans are products of Blue Cross but not BEA. All benefits payable under these insurance plans are subject to the credit risk of Blue Cross. |

| • | Blue Cross (Asia-Pacific) Insurance Limited is a subsidiary of AIA Group Limited. It is not affiliated with or related in any way to Blue Cross and Blue Shield Association or any of its affiliates or licensees. |

| • | All insurance product information available here is not and shall not be construed as an offer to sell or a solicitation to buy or a provision of any insurance products outside Hong Kong. |

| • | For distribution of investment and insurance products: in respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between BEA and the customer out of the selling process or processing of the related transaction, BEA is required to enter into a Financial Dispute Resolution Scheme process with the customer; however, any dispute over the contractual terms of the product should be resolved between the third party service provider and the customer directly. |

This page has not been reviewed by the Securities and Futures Commission in Hong Kong.

Issued by The Bank of East Asia, Limited

Should there be any discrepancy between the English and the Chinese versions of this page, the English version shall apply and prevail.

Applicable to all lending businesses (e.g. consumer loan, mortgage loan, etc.) and credit card business:

Reminder: To borrow or not to borrow? Borrow only if you can repay!

| Contact information | ||||

| BEA Corporate Express (Account Opening Hotline) | 2211 1868 | |||

| Customer Service Hotline | 2211 1333 | |||

| CorporatePlus Account Stock Investment Hotline | 2211 1933 | |||

| Lost CorporatePlus Account Card Reporting Hotline | ||||

| Office hours | 2211 1818 | |||

| Non-office hours | 2211 1862 | |||

| Corporate Cyberbanking | ||||

| Phone | 2211 1838 | |||

| Internet Hotline | 2211 1321 | |||

| Lost PIN Reporting Hotline | ||||

| - | Office hours | 2211 1345 | ||

| - | Non-office hours | 2211 1862 | ||

| MAS Service Hotline | 2211 1822 | |||

+ The relevant information are available in English and Traditional Chinese versions only.

|

|

||||

|

|

||||